how does whole life insurance work

Whole life insurance: This is insurance you buy for the length of your life. Unlike term insurance, whole life policies don't expire. The policy will stay in effect until you pass or until it is canceled. The initial cost of premiums is higher than it is with term insurance because of the length of the policy.

- Why Whole life insurance is a bad idea?

- What happens when a whole life insurance policy matures?

- What is the disadvantage of whole life insurance?

- Is a whole life policy worth it?

- Should I cash out my whole life policy?

- Is whole life insurance worth it for a kid?

- How long does it take for whole life insurance to build cash value?

- What are the pros and cons of whole life insurance?

- Does a whole life policy expire?

Why Whole life insurance is a bad idea?

Policygenius reports that whole life insurance can cost six to 10 times more than a comparable term policy. That greatly increases the odds that you won't be able to afford your premiums at some point down the line. If that happens, you may have no choice but to drop your coverage, leaving your loved ones vulnerable.

What happens when a whole life insurance policy matures?

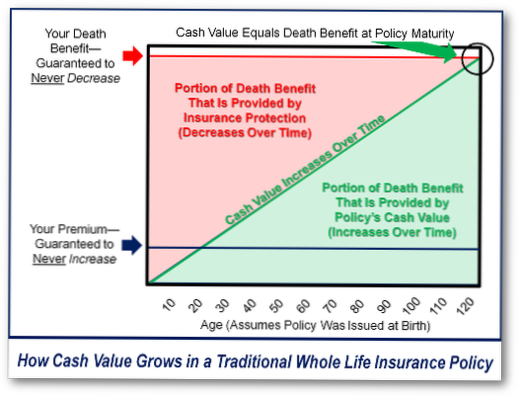

When the policy matures, it simply means that the cash value of the policy now equals the death benefit. ... If your policy matures when you reach 100, it will continue to cover you until age 121…and you won't have to pay premiums. Once a policy matures, the insurer may pay the cash value to the policy owner.

What is the disadvantage of whole life insurance?

Cons of Whole Life Insurance

The corollary to whole life being more expensive is that whatever amount you spend on insurance will buy you a much lower death benefit than you could get with a term policy.

Is a whole life policy worth it?

When it's Worth it to Invest in Life Insurance. Whole life insurance is generally a bad investment unless you need permanent life insurance coverage. If you want lifelong coverage, whole life insurance might be a worthwhile investment if you've already maxed out your retirement accounts and have a diversified portfolio ...

Should I cash out my whole life policy?

Whole life insurance policies are the best option for some people, especially those who will always have dependents due to disabilities and the like. But if you're paying for an expensive policy you don't really need, cashing out may be the best option, even if you have to pay fees and taxes.

Is whole life insurance worth it for a kid?

The shorter the payment period, the higher the premium will be, but it's an option worth considering if you want to turn over a policy that's already paid off to your child. As you can see from the sample rates provided by Hoang below, premiums for a whole life policy are significantly lower for a child than an adult.

How long does it take for whole life insurance to build cash value?

How long does it take for whole life insurance to build cash value? You should expect at least 10 years to build up enough funds to tap into whole life insurance cash value.

What are the pros and cons of whole life insurance?

Whole life insurance has both pros and cons:

- Whole life costs much more than term life insurance.

- The investment portion of the policy typically charges significant fees.

- The insured often has limited control over investment choices.

- Ideal if you need insurance throughout your life.

Does a whole life policy expire?

Unlike term insurance, whole life policies don't expire. ... The initial cost of premiums is higher than it is with term insurance because of the length of the policy. However, part of the premiums you pay builds up into cash value, which you can use later in life.

Yet No Comments