Should You Invest in Target Date Funds? Pros and Cons

- Are Target Date Funds good investments?

- What are the advantages of target date funds?

- What happens to target date funds after target date?

- Are Fidelity target date funds good?

- How do I pick a target date fund?

- What are 2 benefits of investing in a target date fund?

- Are Target Date Funds actively managed?

- Can you invest in multiple target date funds?

- Can you withdraw from a target date fund?

- What might you say to someone whose reason for investing in 90% bonds and 10% stocks is that they want a 6% return on investment?

- Do target date funds pay dividends?

Are Target Date Funds good investments?

For people who aren't going to follow investment markets, learn how to invest, and take a hands-on approach to their retirement, target-date funds are helpful. They're even a smart move for people who are inclined to frequently change their fund allocation inside their 401(k).

What are the advantages of target date funds?

Several advantages of target-date funds include:

- Low minimum investments, allowing for instant diversification among various asset classes (equities, bonds, etc.)

- Professionally managed portfolios, offering a hassle-free investment.

- Low maintenance, as the funds are designed as a one-size-fits-all solution.

What happens to target date funds after target date?

Nothing special happens with a Target Retirement Fund when it reaches its target date. The fund doesn't stop investing, and you don't need to take your money out of the fund. The gradual move from stocks to bonds simply continues.

Are Fidelity target date funds good?

We rate Fidelity's best actively managed funds that are popular in 401(k) plans, including its target-date solutions. Fidelity is all about good stock picking. ... In this year's survey of popular 401(k) funds, which comes courtesy of financial data firm BrightScope, 17 funds from Fidelity rank among the top 100.

How do I pick a target date fund?

Tips for Choosing a Target-Date Fund

- Pick your target date carefully. ...

- Assess how much risk you are willing to take. ...

- Determine whether the fund will take you to or through retirement. ...

- Monitor the glide path of your target-date fund. ...

- Pay attention if automatically enrolled. ...

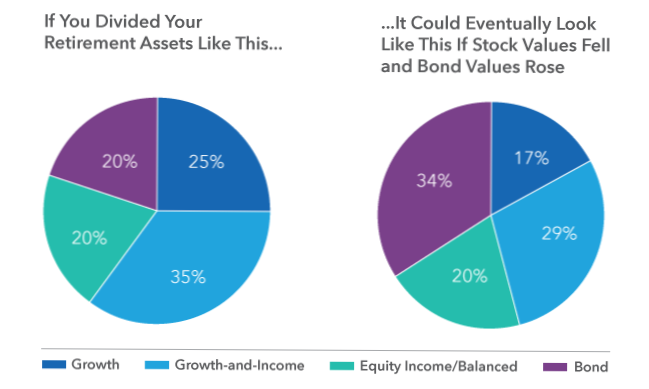

- Keep your "mixed" investments balanced.

What are 2 benefits of investing in a target date fund?

Advantages of Target-Date Funds

- Simplicity of Choice.

- Something for Everyone.

- Not All Funds Are Created Equal.

- Expenses Can Add Up.

- Underlying Funds Offered By Same Company.

- Effect of Other Investments.

- Pre-Retirement Asset Allocation.

- Post-Retirement Investing.

Are Target Date Funds actively managed?

Most target date funds are actively managed, to a degree, meaning their holdings change over time. This means you could face unintended tax consequences if you choose a taxable brokerage account rather than a tax-advantaged 401(k) or IRA.

Can you invest in multiple target date funds?

Investing in multiple target-date funds.

About 10% of target-date investors use more than one vintage, or target date, and among those who are only partially invested in TDFs, that percentage more than doubles, according to the study.

Can you withdraw from a target date fund?

They Only Work While Working: Target Date Funds are also only designed to be used when accumulating wealth for retirement. Once you reach the date, the portfolio doesn't change into one where you can withdraw from it easily. ... Most Target Date Funds simply stop changing the allocation at the Target Date.

What might you say to someone whose reason for investing in 90% bonds and 10% stocks is that they want a 6% return on investment?

Answer: Investing in 90% bonds and 10% stocks will provide an average return of 6% on investment.It is advisable to invest more portion in bonds is safe and will give higher return for investment than stocks.

Do target date funds pay dividends?

Target-date funds with equity investments typically pay dividends on a regular basis. ... Some target-date funds allow investors to reinvest dividend distributions into fund shares instead of actually receiving cash dividends.

Yet No Comments