automatic rebalancing mutual funds

Automatic rebalancing is Acorns's method of maintaining your specific portfolio allocation. Market fluctuations may cause some of the securities in your portfolio to appreciate or depreciate in value. ... This ensures that the securities in your investment account are proportioned correctly.

- What is automatic fund rebalancing?

- Is auto rebalancing a good idea?

- How often do mutual funds rebalance?

- Should I automatically rebalance my portfolio?

- Is it smart to rebalance 401k?

- Why is rebalancing important?

- Should I rebalance during a bear market?

- Does portfolio rebalancing actually improve returns?

- Is rebalancing 401k taxable?

- How do mutual funds rebalance?

- Does rebalancing cost money?

- Does rebalancing trigger capital gains?

What is automatic fund rebalancing?

Automatic Account Rebalancing is an account management feature that automatically keeps your asset allocation in balance according to your most recent investment elections. ... You choose the frequency in which automatic Account Rebalancing takes place – your account can be rebalanced quarterly, semi-annually or annually.

Is auto rebalancing a good idea?

By switching on the rebalancing feature in their 401(k), the account would automatically sell stocks and buy bonds to return to its intended allocation. ... Automatic rebalancing helps to keep risk in check and can potentially enhance returns.

How often do mutual funds rebalance?

Rebalancing a portfolio can take place on two different timetables: either at set time points (quarterly, monthly, annually) or at set allocation points (when the assets change a certain amount). Here's what to know to execute this important investment strategy.

Should I automatically rebalance my portfolio?

Rebalancing back to the original 50/50 allocation periodically will keep your risk exposure in the range that you want. Using a tool like your plan's auto-rebalancing feature can make this “painless” and something that you don't need to worry about.

Is it smart to rebalance 401k?

Rebalancing keeps you from getting too greedy or too fearful, adds Brian Sabo, retirement and estate planner at Verdence Capital Advisors. “The discipline to rebalance helps maintain the long-term risk-and-return objectives of the portfolio,” Sabo says.

Why is rebalancing important?

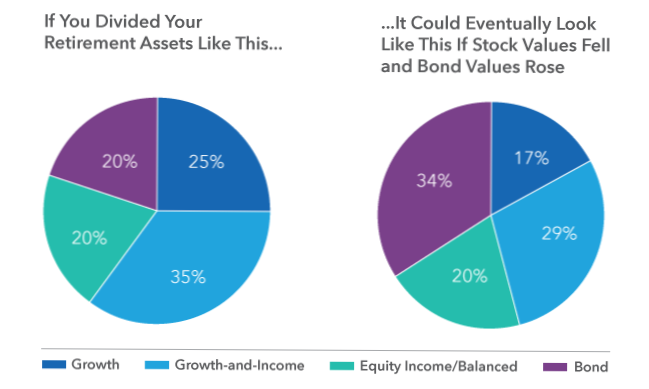

When you do your yearly portfolio checkup, you may find that you need to rebalance. Rebalancing your portfolio—buying or selling asset classes to restore your portfolio to your original target allocation—is an important step in controlling risk.

Should I rebalance during a bear market?

You should consider adopting a portfolio rebalancing strategy—even during down markets when it's tempting to let your “winners” keep growing while your “losers” are taking their lumps. That's because rebalancing helps you “buy low” and “sell high”—an investing adage that's easy to say and hard to do.

Does portfolio rebalancing actually improve returns?

Remember that over the long term, stocks have a significantly higher expected return than bonds. ... For this reason, rebalancing a portfolio of stocks and bonds is therefore likely to lower your returns, not increase them.

Is rebalancing 401k taxable?

Because rebalancing can involve selling assets, it often results in a tax burden—but only if it's done within a taxable account. Selling these assets within a tax-advantaged account instead won't have any tax impact. For example, imagine your retirement savings consist of a taxable account and a traditional IRA.

How do mutual funds rebalance?

To rebalance, you simply make the appropriate trades to return your mutual funds back to their target allocations. For example, returning to our 5 fund portfolio example, you would buy and sell shares of the appropriate funds to get back to the original 20% allocation for each fund.

Does rebalancing cost money?

Rebalancing your portfolio on your own, without the help of a robo-advisor or investment advisor, doesn't require you to spend any money.

Does rebalancing trigger capital gains?

Rebalancing is inherently an inefficient tax process. Investors are always selling assets that moved above the desired allocation, which generally means taking gains. Such gains can be taxable and may add to an individual's reluctance to rebalance.

Yet No Comments