need of health insurance in india

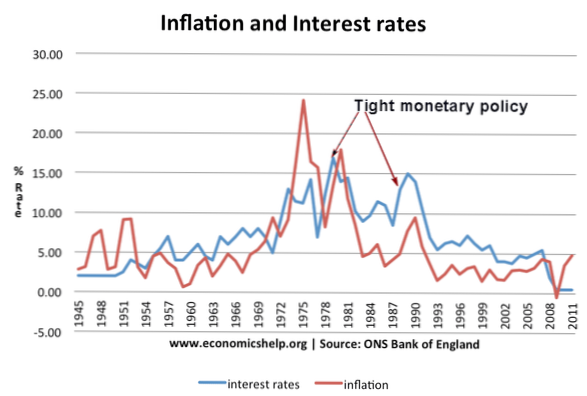

For every individual in India, health insurance has become a necessity. It provides risk coverage against expenditure which is caused by unforeseen medical emergencies. Today, when the medical inflation rates are so high, failing to hold an adequate health cover can prove costly financially.

- What is the need of health insurance?

- Why do you need health insurance in India?

- What is the need of insurance?

- Why health insurance is very important?

- Is it good to take health insurance?

- Is it better to not have health insurance?

- How do I choose health insurance in India?

- Which health insurance is best in India?

- Why we need insurance in our life?

- What are the 4 types of insurance?

- What are the 7 types of insurance?

What is the need of health insurance?

With the constant increasing prices of healthcare in our country, and with the ever rising instances of diseases, health insurance today is a necessity. Health insurance provides people with a much needed financial backup at times of medical emergencies. Health risks and uncertainties are a part of life.

Why do you need health insurance in India?

Health Insurance is necessary for every individual, keeping in mind the rising medical costs and spurt of lifestyle diseases amongst Indians. ... Financial advisors therefore suggest that it is prudent if you to buy a health plan early in life.

What is the need of insurance?

Need for Insurance

Insurance plans will help you pay for medical emergencies, hospitalisation, contraction of any illnesses and treatment, and medical care required in the future. The financial loss to the family due to the unfortunate death of the sole earner can be covered by insurance plans.

Why health insurance is very important?

2. Importance of Health Insurance. Buying a health insurance policy for yourself and your family is important because medical care is expensive, especially in the private sector. Hospitalisation can burn a hole in your pocket and derail your finances.

Is it good to take health insurance?

Health insurance is not only effective in covering future costs but also offers financial relief in the present. You can claim tax deduction* for up to ₹ 25,000 under Section 80D on the premium paid towards a policy. You can claim deductions for your own policy or that of your spouse or children.

Is it better to not have health insurance?

The risks of going uninsured are primarily cost related. Some of the main risks that you could face by going uninsured are: Steep healthcare costs – Without health insurance you may get charged much more for care that would otherwise be covered by your plan.

How do I choose health insurance in India?

7 Tips to Choose a Health Insurance Plan in India

- Look for the right coverage. ...

- Keep it affordable. ...

- Prefer family over individual health plans. ...

- Choose a plan with lifetime renewability. ...

- Compare quotes online. ...

- Network hospital coverage. ...

- High claim settlement ratio. ...

- Choose the kind of plan & enter your details:

Which health insurance is best in India?

Health Insurance Companies

- Star Health Insurance.

- Religare Health Insurance.

- HDFC ERGO Health Insurance.

- Aditya Birla Health Insurance.

- Max Bupa Health Insurance.

- SBI Health Insurance.

- Tata AIG Health Insurance.

- ManipalCigna Health Insurance.

Why we need insurance in our life?

Unforeseen tragedies such as illness, injury or permanent disability, even death – can leave you and your family facing tremendous emotional stress, and even grief. With insurance in place, you or your family's financial stress will be reduced, and you can focus on recovery and rebuilding your lives.

What are the 4 types of insurance?

4 Different Types of General Insurance in India

- Home Insurance. As the home is a valuable possession, it is important to secure your home with a proper home insurance policy. ...

- Motor Insurance. Motor insurance provides coverage for your vehicle against damage, accidents, vandalism, theft, etc. ...

- Travel Insurance. ...

- Health Insurance.

What are the 7 types of insurance?

7 Types of Insurance

- Life Insurance or Personal Insurance.

- Property Insurance.

- Marine Insurance.

- Fire Insurance.

- Liability Insurance.

- Guarantee Insurance.

- Social Insurance.

Yet No Comments