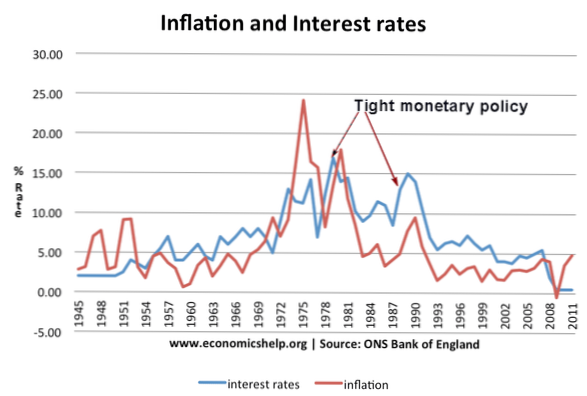

Tight monetary policy

Tight, or contractionary monetary policy is a course of action undertaken by a central bank such as the Federal Reserve to slow down overheated economic growth, to constrict spending in an economy that is seen to be accelerating too quickly, or to curb inflation when it is rising too fast.

- What is tight and loose monetary policy?

- What is the difference between tight and easy monetary policy?

- What is the effect of tight money policies?

- What is Tight money?

- What is an example of a monetary policy?

- Is Loose monetary policy good?

- What are the 3 tools of monetary policy?

- What are tight financial conditions?

- What is easy money tight money?

- What is the difference between tight and loose credit policies?

- What happens if there is too much money in the marketplace?

- What is the relationship between interest rates and demand for money?

What is tight and loose monetary policy?

What is the difference between a tight and a loose monetary policy? In a tight monetary policy, the Fed's actions reduce the money supply, and in a loose monetary policy, the Fed's actions increase the money supply.

What is the difference between tight and easy monetary policy?

Easy money policies are implemented during recessions, while tight money policies are implemented during times of high inflation. Tight money policies are designed to slow business activity and help stabilize prices. The Fed will raise interest rates at this time. What are the main components of monetary policy?

What is the effect of tight money policies?

The aim of tight monetary policy is usually to reduce inflation. With higher interest rates there will be a slowdown in the rate of economic growth. This occurs due to the fact higher interest rates increase the cost of borrowing, and therefore reduce consumer spending and investment, leading to lower economic growth.

What is Tight money?

A situation in which it is difficult to receive credit because of the monetary policy of the central bank. Tight money occurs when the central bank has enacted relatively high target interest rates.

What is an example of a monetary policy?

Monetary policy is the domain of a nation's central bank. ... By buying or selling government securities (usually bonds), the Fed—or a central bank—affects the money supply and interest rates. If, for example, the Fed buys government securities, it pays with a check drawn on itself.

Is Loose monetary policy good?

An expansionary (or loose) monetary policy raises the quantity of money and credit above what it otherwise would have been and reduces interest rates, boosting aggregate demand, and thus countering recession.

What are the 3 tools of monetary policy?

The Fed has traditionally used three tools to conduct monetary policy: reserve requirements, the discount rate, and open market operations.

What are tight financial conditions?

A situation in which it is difficult to receive credit because of the monetary policy of the central bank. Tight money occurs when the central bank has enacted relatively high target interest rates.

What is easy money tight money?

A policy by which a central monetary authority, such as the Federal Reserve System, seeks to make money plentiful and available at low interest rates. (Compare tight-money policy.)

What is the difference between tight and loose credit policies?

Make the distinction between periods of tight and loose monetary policy. ... Increasing interest rates on loans and credit opportunities represent a period of tightening monetary policy, while decreasing interest rates represent a period of loosening monetary policy.

What happens if there is too much money in the marketplace?

If supply is greater than demand, then prices go down. To put it another way, when there's too much product on the market, each unit loses value. The same principle is true for money. If there is too much money in circulation — both cash and credit — then the value of each individual dollar decreases.

What is the relationship between interest rates and demand for money?

The demand for money is related to income, interest rates and whether people prefer to hold cash(money) or illiquid assets like money. This shows that the demand for money is inversely related to the interest rate. At high-interest rates, people prefer to hold bonds (which give a high-interest payment).

Yet No Comments