is my portfolio diversified

- How do you know if a portfolio is diversified?

- What makes a portfolio diversified?

- What is an example of a diversified portfolio?

- What does a diverse portfolio look like?

- What does a balanced portfolio look like?

- What does a good investment portfolio look like?

- What is the best diversified portfolio?

- What is the ideal stock portfolio?

- How do you rebalance a portfolio?

- How do you build a diversified portfolio?

- How many funds should be in a diversified portfolio?

- What does an aggressive portfolio look like?

How do you know if a portfolio is diversified?

To achieve a diversified portfolio, look for asset classes that have low or negative correlations so that if one moves down the other tends to counteract it. ETFs and mutual funds are easy ways to select asset classes that will diversify your portfolio but one must be aware of hidden costs and trading commissions.

What makes a portfolio diversified?

Diversification is the practice of spreading your investments around so that your exposure to any one type of asset is limited. This practice is designed to help reduce the volatility of your portfolio over time. ... One way to balance risk and reward in your investment portfolio is to diversify your assets.

What is an example of a diversified portfolio?

Equities, fixed income (bonds), and cash are asset classes. And you can invest in those asset classes via individual securities such as stocks and bonds, or via funds such as ETFs or mutual funds. For cash you can have a deposit or money market account, a CD, or a money market mutual fund, etc.

What does a diverse portfolio look like?

A typical diversified portfolio has a mixture of stocks, fixed income, and commodities. Diversification works because these assets react differently to the same economic event.

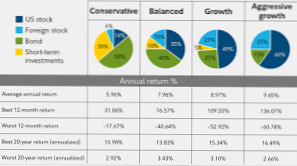

What does a balanced portfolio look like?

Typically, balanced portfolios are divided between stocks and bonds, either equally or tilted to 60% stocks and 40% bonds. Balanced portfolios may also maintain a small cash or money market component for liquidity purposes.

What does a good investment portfolio look like?

A good investment portfolio generally includes a range of blue chip and potential growth stocks, as well as other investments like bonds, index funds and bank accounts.

What is the best diversified portfolio?

A diversified portfolio should have a broad mix of investments. For years, many financial advisors recommended building a 60/40 portfolio, allocating 60% of capital to stocks and 40% to fixed-income investments such as bonds. Meanwhile, others have argued for more stock exposure, especially for younger investors.

What is the ideal stock portfolio?

While there is no "perfect" portfolio size, the generally agreed upon number is 20 to 30 stocks. When managing your portfolio, it's important to consider a diversification strategy that mixes a variety of investments spread across asset classes and industries.

How do you rebalance a portfolio?

To rebalance, you simply make the appropriate trades to return your mutual funds back to their target allocations. For example, returning to our 5 fund portfolio example, you would buy and sell shares of the appropriate funds to get back to the original 20% allocation for each fund.

How do you build a diversified portfolio?

How to diversify your portfolio

- Step 1: Ensure your portfolio has many different investments. ETFs & mutual funds. ...

- Step 2: Diversify within individual types of investments. Pick investments with different rates of returns. ...

- Step 3: Consider investments with varying risk. ...

- Step 4: Rebalance your portfolio regularly.

How many funds should be in a diversified portfolio?

Diversification and Mutual Fund Types

If you are like most investors and have a moderate to low tolerance for risk, it is best to hold at least three or four mutual funds with different styles and objectives.

What does an aggressive portfolio look like?

Aggressive portfolios typically include more stocks than moderate and conservative portfolios, so they tend to produce greater volatility than other types of portfolios that hold lots of fixed investments like bonds.

Yet No Comments