How to Stretch Your Paycheck and Make It Last Longer

10 Tips to Stretch Your Paycheck This Month

- Use a budget. Make a plan for how you're going to spend your money. ...

- Shop (only) the sales. Plan your spending around the sales. ...

- Plan fun nights/weekends at home. You don't have to stop having fun because money is tight. ...

- FIY: Fix it yourself. ...

- Use coupons. ...

- Stick to water. ...

- Skip the restaurants. ...

- Buy items in bulk.

- How can I make my paycheck last longer?

- How can I make my money last until payday?

- What strategies will you use to make your dollar go further?

- How do I divide my paycheck?

- How do I survive until payday?

- How do you save when you get paid monthly?

- How do you stretch a tight budget?

- How do you budget when living paycheck to paycheck?

- How do I manage my money weekly?

- What is the 70 20 10 Rule money?

- How can I save my paycheck?

- How should I use my paycheck?

How can I make my paycheck last longer?

5 Ideas to Make Your Paycheck Last Longer

- 1) Bump up your take-home pay. Have you started a family in the last few years? ...

- 2) Put yourself on a daily budget. When it's payday keep spending your money like you don't have any. ...

- 3) Kick the coffee habit. ...

- 4) Do some repairs yourself. ...

- 5) Stop spending because of a guilty conscience.

How can I make my money last until payday?

How to Make Your Last $20 Stretch Until Your Next Payday

- First, focus on your critical expenses. ...

- Don't pay full price – use coupons. ...

- Avoid buying any more gas. ...

- Eat out of your pantry. ...

- Get your entertainment free at your local library. ...

- Learn to negotiate. ...

- Find free stuff online. ...

- Reschedule your social commitments.

What strategies will you use to make your dollar go further?

8 Money Experts Answer: 'What Are the Best Ways to Stretch a... '

- Freeze your spending habits. ...

- Invest your money. ...

- Pay with cash whenever possible. ...

- Maximize your saving opportunities. ...

- Maintain your cash flow. ...

- Put grocery spending on a diet. ...

- Learn the art of negotiation. ...

- Be mindful of your spending.

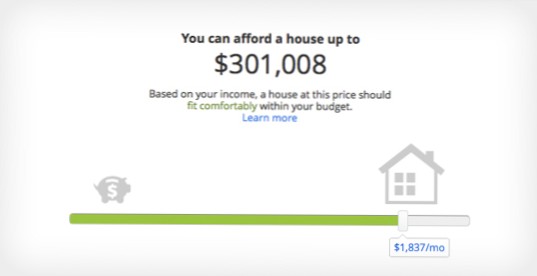

How do I divide my paycheck?

The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.

How do I survive until payday?

Here's a step-by-step guide on how to make sure you don't get into debt this month.

- Work out what money you have.

- Use cash, not your debit card.

- Give up luxuries.

- Explore saving opportunities.

- Get selling.

- Don't look for easy options.

How do you save when you get paid monthly?

If you are paid once a month, one option is to set up your bills to all arrive as soon as you get paid. Most companies will allow you to set up a direct debit to pay your bills. 1 It is easier to do this just once a month, and it saves you time since you are doing everything all together.

How do you stretch a tight budget?

Here are a few money saving tips that are completely painless.

- Eat at home. ...

- Plan your meals. ...

- Stretch meals with beans, rice and vegetables. ...

- Use less meat. ...

- Only buy what you eat. ...

- Stick to a list. ...

- Stick to a routine. ...

- Don't beat yourself up about cooking from scratch.

How do you budget when living paycheck to paycheck?

How to Create a Budget When You're Living Paycheck to Paycheck

- Begin by Tracking Your Spending. It all starts with knowing where your money is going, down to the last cent. ...

- Compile a List of Expenses. ...

- Do the Math. ...

- Analyze Your Actual Spending. ...

- Look for ways to increase income. ...

- Use Your Budget as a Tool. ...

- Get the Latest Financial Tips.

How do I manage my money weekly?

- 5 Steps To Budget When You Get Paid Weekly [Updated For 2021] December 29, 2020. ...

- Step 1: Know your paydays. ...

- Step 2: Add your bills to the same calendar. ...

- Step 3: List out all other expenses. ...

- Step 4: “Assign” your paychecks to cover your bills and expenses. ...

- Step 5: Write your weekly budget.

What is the 70 20 10 Rule money?

You take your monthly take-home income and divide it by 70%, 20%, and 10%. You divvy up the percentages as so: 70% is for monthly expenses (anything you spend money on). 20% goes into savings, unless you have pressing debt (see below for my definition), in which case it goes toward debt first.

How can I save my paycheck?

10 Tips on how to save money from salary

- Budget before each paycheck. ...

- Set up direct deposit to save automatically. ...

- Track your spending. ...

- Reduce your costs on the your 3 expenses. ...

- Evaluate current your service providers and other expenses. ...

- Tweak your utility usage. ...

- Make access to your money inconvenient.

How should I use my paycheck?

How Much Should You Save Each Month? Based on the 50/30/20 rule, 20 percent of your income should go to savings and retirement. The remainder of your paycheck is then divvied up between necessities and wants, with 50 percent going towards necessities, like rent, and 30 percent towards your wants.

Yet No Comments