how much house can i afford zillow

- How much house can I afford based on my salary?

- What salary do you need to buy a 400k house?

- How much income is needed to buy a $300 000 house?

- How much can I afford for a home Zillow?

- Can I buy a house making 40k a year?

- What is the ideal credit score to buy a house?

- How much income do you need to buy a $500000 house?

- What house can I afford on 50k a year?

- What house can I afford on 70k a year?

- What mortgage can I afford on 60k?

- How much income do I need to buy a 250k house?

- Can I buy a house with 20k income?

How much house can I afford based on my salary?

To calculate 'how much house can I afford,' a good rule of thumb is using the 28%/36% rule, which states that you shouldn't spend more than 28% of your gross monthly income on home-related costs and 36% on total debts, including your mortgage, credit cards and other loans like auto and student loans.

What salary do you need to buy a 400k house?

To afford a $400,000 house, for example, you need about $55,600 in cash if you put 10% down. With a 4.25% 30-year mortgage, your monthly income should be at least $8178 and (if your income is $8178) your monthly payments on existing debt should not exceed $981.

How much income is needed to buy a $300 000 house?

How much do you need to make to be able to afford a house that costs $300,000? To afford a house that costs $300,000 with a down payment of $60,000, you'd need to earn $44,764 per year before tax. The monthly mortgage payment would be $1,044. Salary needed for 300,000 dollar mortgage.

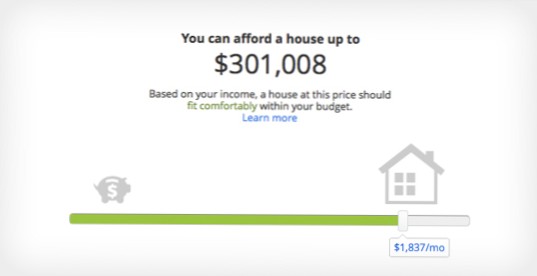

How much can I afford for a home Zillow?

This ratio says that your monthly mortgage costs (which includes property taxes and homeowners insurance) should be no more than 36% of your gross monthly income, and your total monthly debt (including your anticipated monthly mortgage payment and other debts such as car or student loan payments) should be no more than ...

Can I buy a house making 40k a year?

Yes, you can! Your mortgage payment including taxes and insurance will be around $1,178.78. 81 (4.625% rate due to low fico score and low downpayment). Based on the information you provided, your Debt-to-income ratio is around 40% which makes you a qualified buyer.

What is the ideal credit score to buy a house?

The answer depends on what type of mortgage you want. You'll need a FICO credit score of at least 500 to qualify for a Federal Housing Administration, or FHA, loan, but other programs may require a score of 620 or higher. Some lenders may have even tougher standards to guard against risk during the pandemic downturn.

How much income do you need to buy a $500000 house?

A generally accepted rule of thumb is that your mortgage shouldn't be more than three times your annual income. So if you make $165,000 in household income, a $500,000 house is the very most you should get.

What house can I afford on 50k a year?

A person who makes $50,000 a year might afford a house worth anywhere from $180,000 to nearly $300,000. That's because salary isn't the only thing that determines your home buying budget. You also have to factor in credit score, current debts, mortgage rates, and many other factors.

What house can I afford on 70k a year?

According to Brown, you should spend between 28% to 36% of your take-home income on your housing payment. If you make $70,000 a year, your monthly take-home pay, including tax deductions, will be approximately $4,328.

What mortgage can I afford on 60k?

The usual rule of thumb is that you can afford a mortgage two to 2.5 times your annual income. That's a $120,000 to $150,000 mortgage at $60,000. You also have to be able to afford the monthly mortgage payments, however. ... You can cover a $1,400 monthly PITI housing payment if your monthly income is $5,000.

How much income do I need to buy a 250k house?

To afford a house that costs $250,000 with a down payment of $50,000, you'd need to earn $37,303 per year before tax. The monthly mortgage payment would be $870. Salary needed for 250,000 dollar mortgage. This page will calculate how much you need to earn to buy a house that costs $250,000.

Can I buy a house with 20k income?

The DTI is the total house payment including taxes, insurance and mortgage insurance if any, plus any debt payments, divided by your gross monthly income. Lenders can approve conventional loans with a DTI up to 50%. ... You have no debt and a 3% down payment. You'll qualify for a home of about $200,000.

Yet No Comments