How to Set Up an Allocated Spending Plan

Four Steps to Implement the Dave Ramsey Allocated Spending Plan

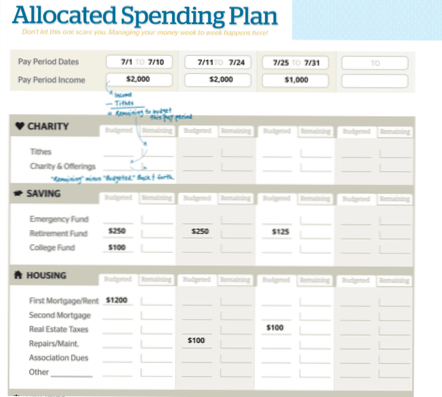

- Step #1: Insert your pay periods and expenses into the allocated spending plan.

- Step #2: Determine your expenses.

- Step #3: Track your expenses.

- Step #4: Rebalance to zero.

- How do you allocate your spending?

- How do I create a spend plan?

- What are the five steps to creating a budget?

- How do you create a monthly budget for a beginner?

- What is the 70 20 10 Rule money?

- How do I stop living paycheck to paycheck?

- What are monthly expenses for planning?

- What is the difference between a spending plan and a budget?

- How do you create a smart budget?

- How do you make a budget stick to it?

- What are the main steps in creating a budget?

- What are optional expenses?

How do you allocate your spending?

The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings. 1 Here, we briefly profile this easy-to-follow budgeting plan.

How do I create a spend plan?

Start a Spending Plan

- Add up your monthly expenses. ...

- Add up your household's monthly take-home pay. ...

- Subtract your expenses from your income. ...

- List your other financial priorities, such as building up an emergency fund, paying off credit card debt and saving for retirement or college. ...

- Match your money with your expenses and your goals.

What are the five steps to creating a budget?

Here's how to create a budget in five steps.

...

- Calculate your net income. ...

- List monthly expenses. ...

- Label fixed and variable expenses. ...

- Determine average monthly cost for each expense. ...

- Make adjustments.

How do you create a monthly budget for a beginner?

How to Create a Monthly Budget in 6 Steps

- TOTAL YOUR MONTHLY TAKE-HOME PAY.

- ADD UP WHAT YOU SPEND ON FIXED EXPENSES.

- ADD UP WHAT YOU SPEND ON NON-MONTHLY COSTS.

- ADD UP CONTRIBUTIONS TO FINANCIAL GOALS.

- ADD UP YOUR DISCRETIONARY SPENDING.

- DO SOME SIMPLE MATH.

What is the 70 20 10 Rule money?

You take your monthly take-home income and divide it by 70%, 20%, and 10%. You divvy up the percentages as so: 70% is for monthly expenses (anything you spend money on). 20% goes into savings, unless you have pressing debt (see below for my definition), in which case it goes toward debt first.

How do I stop living paycheck to paycheck?

10 Ways to Stop Living Paycheck to Paycheck

- Get on a budget. Don't know where your entire paycheck goes? ...

- Take care of the Four Walls first. ...

- Stop living with debt. ...

- Sell stuff. ...

- Get a temporary job or start a side hustle. ...

- Live below your means. ...

- Look for things to cut. ...

- Save up for big purchases.

What are monthly expenses for planning?

Separate your monthly bills into three categories: needs, wants and savings/debt repayment.

...

Needs

- Mortgage/rent.

- Homeowners or renters insurance.

- Property tax (if not already included in the mortgage payment).

- Auto insurance.

- Health insurance.

- Out-of-pocket medical costs.

- Life insurance.

- Electricity and natural gas.

What is the difference between a spending plan and a budget?

So if you hate the idea of creating a budget, don't. Instead, you can make a spending plan. What's the difference between a spending plan and a budget? Well, a spending plan allows you to choose what you must spend money on each month, and then gives you the freedom to do whatever you want with the rest.

How do you create a smart budget?

7 Steps to a Budget Made Easy

- Step 1: Set Realistic Goals. Goals for your money will help you make smart spending choices. ...

- Step 2: Identify your Income and Expenses. ...

- Step 3: Separate Needs and Wants. ...

- Step 4: Design Your Budget. ...

- Step 5: Put Your Plan into Action. ...

- Step 6: Seasonal Expenses. ...

- Step 7: Look Ahead.

How do you make a budget stick to it?

11 Ways to Stick to your Budget and Jump Start your Savings

- Sleep on big purchases. If it's not something you need, take a week to think on it. ...

- Never spend more than you have. ...

- Stick to a lower credit card limit. ...

- Budget to zero. ...

- Try a no-spend challenge. ...

- Go minimal. ...

- Plan your meals. ...

- Do your grocery shopping online.

What are the main steps in creating a budget?

The following steps can help you create a budget.

- Step 1: Note your net income. The first step in creating a budget is to identify the amount of money you have coming in. ...

- Step 2: Track your spending. ...

- Step 3: Set your goals. ...

- Step 4: Make a plan. ...

- Step 5: Adjust your habits if necessary. ...

- Step 6: Keep checking in.

What are optional expenses?

“Optional” expenses are those you CAN live without. These are also expenses that can be postponed when expenses exceed income or when your budgeting goal allows for it. Examples are books, cable, the internet, restaurant meals and movies.

Yet No Comments