how to calculate depreciation on rental property

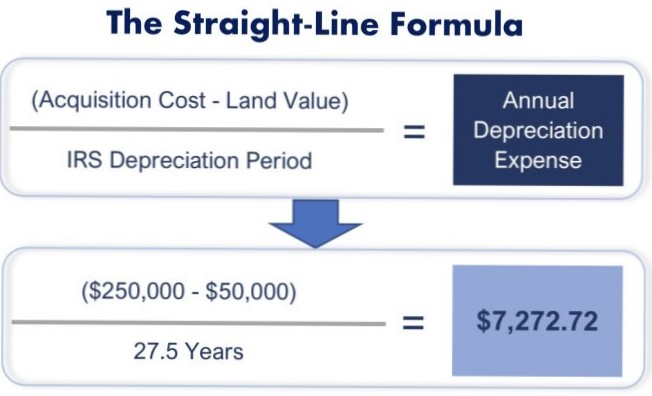

To calculate the annual amount of depreciation on a property, you divide the cost basis by the property's useful life. In our example, let's use our existing cost basis of $206,000 and divide by the GDS life span of 27.5 years. It works out to being able to deduct $7,490.91 per year or 3.6% of the loan amount.

- How much depreciation can you claim on a rental property?

- What is the best depreciation method for rental property?

- How do you calculate depreciation?

- What happens if I don't depreciate my rental property?

- What happens when rental property is fully depreciated?

- How do you avoid depreciation recapture on rental property?

- How do you depreciate flooring in a rental property?

- What is the formula for straight line depreciation?

- What are the 3 depreciation methods?

- What is the normal depreciation rate?

How much depreciation can you claim on a rental property?

Depreciation commences as soon as the property is placed in service or available to use as a rental. By convention, most U.S. residential rental property is depreciated at a rate of 3.636% each year for 27.5 years. Only the value of buildings can be depreciated; you cannot depreciate land.

What is the best depreciation method for rental property?

The depreciation method used for rental property is MACRS. There are two types of MACRS: ADS and GDS. GDS is the most common method that spreads the depreciation of rental property over its useful life, which the IRS considers to be 27.5 years for a residential property.

How do you calculate depreciation?

Straight-Line Method

- Subtract the asset's salvage value from its cost to determine the amount that can be depreciated.

- Divide this amount by the number of years in the asset's useful lifespan.

- Divide by 12 to tell you the monthly depreciation for the asset.

What happens if I don't depreciate my rental property?

However, not depreciating your property will not save you from the tax – the IRS levies it on the depreciation that you should have claimed, whether or not you actually did. With this in mind, depreciating your property doesn't hurt you when you sell it, but it really helps you while you own it.

What happens when rental property is fully depreciated?

Depreciation will play a role in the amount of taxes you'll owe when you sell. Because depreciation expenses lower your cost basis in the property, they ultimately determine your gain or loss when you sell. ... If you hold the property for at least a year and sell it for a profit, you'll pay long-term capital gains taxes.

How do you avoid depreciation recapture on rental property?

If you're facing a large tax bill because of the non-qualifying use portion of your property, you can defer paying taxes by completing a 1031 exchange into another investment property. This permits you to defer recognition of any taxable gain that would trigger depreciation recapture and capital gains taxes.

How do you depreciate flooring in a rental property?

Most types of flooring and other capital assets get depreciated by dividing their value by a set number of years, called a recovery period. Every year, you take a write off for the amount that you calculated until the recovery period ends and you have written the asset's value down to zero.

What is the formula for straight line depreciation?

Also known as straight line depreciation, it is the simplest way to work out the loss of value of an asset over time. Straight line basis is calculated by dividing the difference between an asset's cost and its expected salvage value by the number of years it is expected to be used.

What are the 3 depreciation methods?

Various Depreciation Methods

- Straight Line Depreciation Method.

- Diminishing Balance Method.

- Sum of Years' Digits Method.

- Double Declining Balance Method.

- Sinking Fund Method.

- Annuity Method.

- Insurance Policy Method.

- Discounted Cash Flow Method.

What is the normal depreciation rate?

On average, a new vehicle depreciates 19 percent in the first year, half of which occurs immediately after you take possession. Fortunately, depreciation does not continue at this rate. You can expect a 15 percent drop in the second and third years.

Yet No Comments