how many stocks beat the sp 500

- What stocks have beat the S&P 500?

- Does anything outperform the S&P 500?

- What percentage of traders beat the market?

- How many stocks are in the S&P 500 down in 2020?

- What ETF is better than S&P 500?

- Is it easy to beat the S&P?

- Is it hard to beat the S&P 500?

- Do Day Traders Beat the Market?

- Does Berkshire Hathaway beat the S&P 500?

- Can Day Trading make you rich?

- Why do most traders lose money?

- How many people can beat the stock?

What stocks have beat the S&P 500?

All 8 Highest-Yielding S&P 500 Stocks Are Beating The Market

- Energy. XLE. 2.75%

- Materials. XLB. 1.49%

- Health Care. XLV. 1.14%

- Industrials. XLI. 1.03%

- Consumer Staples. XLP. 0.82%

- Financials. XLF. 0.5%

- Utilities. XLU. -0.01%

- Information Technology. XLK. -0.28%

Does anything outperform the S&P 500?

Yes, you may be able to beat the market, but with investment fees, taxes, and human emotion working against you, you're more likely to do so through luck than skill. If you can merely match the S&P 500, minus a small fee, you'll be doing better than most investors.

What percentage of traders beat the market?

Anyone who starts down the road to becoming a trader eventually comes across the statistic that 90 per cent of traders fail to make money when trading the stock market. This statistic deems that over time 80 per cent lose, 10 per cent break even and 10 per cent make money consistently.

How many stocks are in the S&P 500 down in 2020?

While many stocks did well, 198 of the S&P 500 Index's SPX, -0.72% components lost ground in 2020. Further down in this article, you'll find a list of the 20 worst-performing S&P stocks.

What ETF is better than S&P 500?

Best index funds for May 2021

Fidelity ZERO Large Cap Index. Vanguard S&P 500 ETF. SPDR S&P 500 ETF Trust.

Is it easy to beat the S&P?

It is widely acknowledged to be one of the most efficient markets and most difficult benchmarks to beat. For a typical pension plan, 35-40 % of all capital is invested in the S&P 500.

Is it hard to beat the S&P 500?

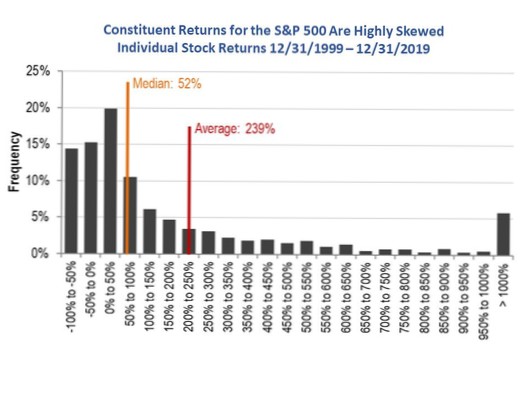

As noted above, for the 20 years ended 2019, 74% of stocks in the S&P 500 under-performed the average and year-to-date in 2020 (thru 8/26), 68% have under-performed. ... Of course, this is difficult to do, but not impossible as some investment managers are adept at picking the relatively few high performing stocks.

Do Day Traders Beat the Market?

“It turned out that less than 1% of day traders were able to beat the market returns available from a low-cost ETF. Moreover, over 80% of them actually lost money,” Malkiel says, citing a Taiwanese study.

Does Berkshire Hathaway beat the S&P 500?

Over the past two decades, Buffett has done reasonably well against the index, actually beating the S&P 500 in 12 calendar years between 1999 and 2020. ... In 2020, Berkshire Hathaway shares were up, but not by much (2%), against an S&P 500 that gained over 18%, with dividends reinvested, according to S&P Global.

Can Day Trading make you rich?

If you want to really make a lot of money you'll probably have to establish multiple streams of income and invest some of what you make. If you just day trade you can become a millionaire over a number of years…but only if you save, don't rack up debt, and invest some of your proceeds…just like people in normal jobs.

Why do most traders lose money?

All sorts of reasons are given for the losses, including poor money management, bad timing, or a poor strategy. These factors do play a role in individual trading success…but there is a deeper reason why most people lose. Most traders will lose regardless of what methods they employ.

How many people can beat the stock?

According to a 2020 report, over a 15-year period, nearly 90% of actively managed investment funds failed to beat the market. Portfolio managers are often Ivy League-educated investors who spend their entire workday attempting to outperform the stock market.

Yet No Comments