Financial Planning Guide for Musicians

Financial Planning For Musicians: 6 Steps to Financial Security

- Set career goals based on best assumptions. ...

- Set Your Annual Income Goal. ...

- Select your revenue streams. ...

- Calculate your annual income. ...

- Decide on your strategies and take action. ...

- Review and update your plan. ...

- 5 Questions to Daniel Felsenfeld (The New Music Gathering)

- How do musicians manage their finances?

- Do musicians make a lot of money?

- What should a financial plan include?

- How do I become a musician on a budget?

- Why do most musicians fail?

- How many musicians are successful?

- Where do musicians make the most money?

- What are the 7 key components of financial planning?

- What are the two major types of financial plans?

- What are the six components of financial planning?

How do musicians manage their finances?

Here are five money management tips for musicians.

- Money Management Tip 1. Get Out & Stay Out Of Debt.

- Tip 2. Open A Separate Checking Account For Your Music.

- Save At Least 10% Of Your Income From Music And Outside.

- Reinvest In Your Music Career.

- Create Multiple Streams Of Income.

- Final Thoughts.

Do musicians make a lot of money?

Musicians make money from royalties, advances, playing live, selling merchandise, and licensing fees for their music. Sounds like a lot of revenue streams, but don't forget they often have to share the money with the people listed above: mechanical royalties and performance rights royalties.

What should a financial plan include?

A financial plan is a comprehensive picture of your current finances, your financial goals and any strategies you've set to achieve those goals. Good financial planning should include details about your cash flow, savings, debt, investments, insurance and any other elements of your financial life.

How do I become a musician on a budget?

Here are some ways budgeting can help you make more money as an independent musician.

- Give yourself a raise. ...

- Consider multiple revenue streams. ...

- Remove extra expenses from your monthly bills. ...

- Seek out a lower-cost lifestyle. ...

- Stop using credit cards for things you can't afford. ...

- Pay off your debt. ...

- Utilize travel rewards.

Why do most musicians fail?

There are a variety of reasons musicians and indie artists fail. Some lack real talent or work ethic. ... We know there are a million and one reasons artists fail. But the #1 top reason they fail is simple: it all boils down to not having the right MINDSET.

How many musicians are successful?

The truth is, only about 0.000002% of musicians become “successful”. According to most people's definition anyway. Yes you read that right, 0.000002% and that is already being generous. This is the main reason why musicians who possess an insane amount of skill and talent don't become “successful”.

Where do musicians make the most money?

An article from TorrentFreak indicates that the top eight revenue streams for musicians are (5,000 artists were surveyed): Touring, shows, or live performance fees. Live performance accounts for 28% of an average musician's income, and is the largest piece of the pie.

What are the 7 key components of financial planning?

A good financial plan contains seven key components:

- Budgeting and taxes.

- Managing liquidity, or ready access to cash.

- Financing large purchases.

- Managing your risk.

- Investing your money.

- Planning for retirement and the transfer of your wealth.

- Communication and record keeping.

What are the two major types of financial plans?

Types of Financial Planning Models and Strategies

- Cash Flow Planning. It is one of the important types of financial planning. ...

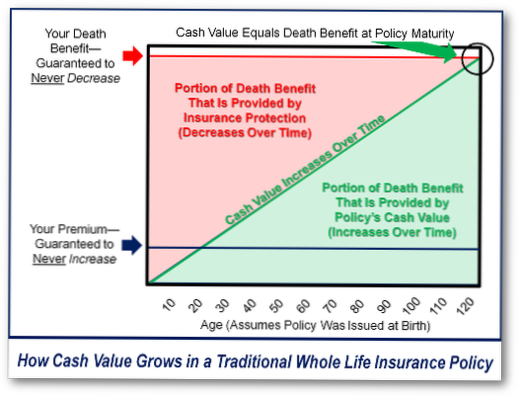

- Insurance Planning. Insurance coverage for a long term is very crucial type of financial planning. ...

- Retirement Planning. It is the event which occurs in everyone's life. ...

- Investment Planning. ...

- Tax Planning. ...

- Real Estate Planning.

What are the six components of financial planning?

There are typically six parts to a full financial plan: sales forecasting, expense outlay, a statement of financial position, cash flow projection, break-even analysis and an operations plan.

Yet No Comments