COBRA Health Insurance Guide - Continue Coverage After Ending a Job

You'll have 60 days to enroll in COBRA — or another health plan — once your benefits end. But keep in mind that delaying enrollment won't save you money. COBRA is always retroactive to the day after your previous coverage ends, and you'll need to pay your premiums for that period too.

- How does Cobra insurance work if I quit my job?

- How long can you keep health insurance after leaving a job?

- Does my health insurance continue after I quit my job?

- Can you extend Cobra coverage?

- How do I get Cobra insurance after termination?

- Does Cobra insurance start immediately?

- How long do benefits last after termination?

- Why is Cobra so expensive?

- What happens to health insurance when laid off?

- How much does Cobra cost a month?

- Can you get Cobra if you are fired?

How does Cobra insurance work if I quit my job?

After you quit or lose a job, you can temporarily continue your employer-sponsored health insurance coverage through a federal law known as COBRA. ... COBRA lets you extend your former employer's health plan. COBRA requires you to pay 100% of the health insurance costs plus up to 2% adminstrative fee.

How long can you keep health insurance after leaving a job?

When you leave your job you have a few choices. You can choose to stay with your employer's health insurance plan for up to 18 months, get insurance coverage through a government health care exchange, or another insurer.

Does my health insurance continue after I quit my job?

Employers decide whether to continue health insurance coverage for the rest of the month or your last day -- regardless of whether you are terminated or quit. ... Under COBRA, if you voluntarily resign from a job, you're entitled to continue your employer's group plan for up to 18 months at your own expense.

Can you extend Cobra coverage?

If you are entitled to an 18 month maximum period of continuation coverage, you may become eligible for an extension of the maximum time period in two circumstances. The first is when a qualified beneficiary is disabled; the second is when a second qualifying event occurs.

How do I get Cobra insurance after termination?

After learning of a qualifying event, the administrator must send out an election notice, informing beneficiaries that they have a right to choose COBRA coverage. Beneficiaries then have 60 days to inform the administrator whether or not they want to continue insurance coverage through COBRA.

Does Cobra insurance start immediately?

You'll have 60 days to enroll in COBRA — or another health plan — once your benefits end. But keep in mind that delaying enrollment won't save you money. COBRA is always retroactive to the day after your previous coverage ends, and you'll need to pay your premiums for that period too.

How long do benefits last after termination?

Health insurance is active for at least 2 months after termination, in most cases, but some people keep their coverage for up to 3 years.

Why is Cobra so expensive?

The cost of COBRA coverage is usually high because the newly unemployed individual pays the entire cost of the insurance (employers usually pay a significant portion of healthcare premiums for employees).

What happens to health insurance when laid off?

If you are laid off, your employer benefits like health insurance are also terminated. However, a federal program known as COBRA (Consolidated Omnibus Budget Reconciliation Act) allows you to keep your group plan for up to 3 years after your employment ends.

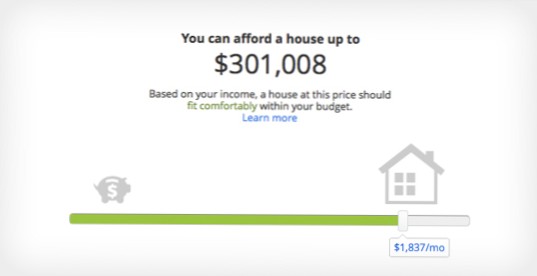

How much does Cobra cost a month?

But employers covered 82% of the costs for individuals and 69% for families on average. With COBRA insurance, you're on the hook for the whole thing. That means you could be paying average monthly premiums of $569 to continue your individual coverage or $1,595 for family coverage—maybe more!

Can you get Cobra if you are fired?

If your boss fires you, you quit, or there's a mass layoff, you're eligible for COBRA. You also qualify if your hours are reduced so that you don't qualify for regular coverage. About the only thing that disqualifies you is if your employer fires you for gross misconduct. In that case, you're not covered by COBRA.

Yet No Comments