10 IRA Rules Everyone Should Know

10 IRA Rules Everyone Should Know

- Rule #1: You Don't Have to Contribute Every Year. ...

- Rule #2: An IRA Can Only Be Owned by an Individual. ...

- Rule #3: You Need Earned Income to Qualify. ...

- Rule #4: Minors Qualify Too. ...

- Rule #5: Spouses Without Earned Income May Qualify. ...

- Rule #6: You Can't Make IRA Contributions for Someone Else.

- What is the 10 year distribution rule?

- How does the 10 year rule work?

- Can you lose all your money in an IRA?

- What are the rules for an IRA?

- At what age does RMD stop?

- What is the 10 year rule psychology?

- What happens to an IRA when someone dies?

- Is it better to inherit or assume an IRA?

- What happens if you inherit your spouse's IRA?

- Is it better to have a 401k or IRA?

- How do I protect my IRA from the market crash?

- What are the disadvantages of an IRA?

What is the 10 year distribution rule?

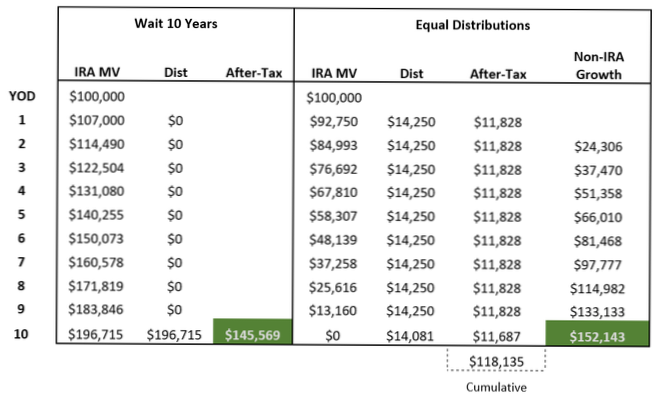

THE 10-YEAR RULE. One of the big changes in the SECURE Act was the elimination of the stretch IRA for most non-spouse beneficiaries. It was replaced with the “10-year rule,” which says the inherited IRA (or Roth IRA) funds must be withdrawn by the end of the 10-year period after the death of the IRA owner.

How does the 10 year rule work?

Starting in 2020, for IRAs passing to most non-spouse beneficiaries (not including minor children of the owner, chronically ill or disabled, those less than 10 years younger, and properly drafted “see-through” trusts), the entire IRA must be distributed by the end of the 10th year following the owner's death.

Can you lose all your money in an IRA?

The most likely way to lose all of the money in your IRA is by having the entire balance of your account invested in one individual stock or bond investment, and that investment becoming worthless by that company going out of business. You can prevent a total-loss IRA scenario such as this by diversifying your account.

What are the rules for an IRA?

Quick summary of IRA rules

- The maximum annual contribution limit for 2020 is $6,000 (or $7,000 if you're age 50 or older).

- Contributions may be tax-deductible in the year they are made.

- Investments within the account grow tax-deferred.

- Withdrawals in retirement are taxed as ordinary income.

At what age does RMD stop?

You reach age 70½ after December 31, 2019, so you are not required to take a minimum distribution until you reach 72. You reached age 72 on July 1, 2021. You must take your first RMD (for 2021) by April 1, 2022, with subsequent RMDs on December 31st annually thereafter.

What is the 10 year rule psychology?

First identified by the psychologist John Hayes in 1989 and soon endorsed by other psychologists, the rule states that a person must persevere with learning and practising a craft or discipline for about 10 years before he or she can make a breakthrough.

What happens to an IRA when someone dies?

An inherited IRA is an IRA opened when you inherit a tax-advantaged retirement plan (including an IRA or a retirement-sponsored plan such as a 401(k)) following the death of the owner. An heir will typically have to move assets from the original owner's account to a newly opened IRA in the heir's name.

Is it better to inherit or assume an IRA?

One of the main advantages of assuming an IRA, as opposed to inheriting it, is that you don't have to immediately begin taking annual distributions. You will not have to take any money out of your assumed IRA until April 1 after you turn 70 1/2, per IRS regulations.

What happens if you inherit your spouse's IRA?

When the surviving spouse chooses the inherited IRA option and passes away before starting RMDs, then the next generation of beneficiaries must begin RMDs by the end of the year following the surviving spouse's death, but they can use their own life expectancy to compute those RMDs.

Is it better to have a 401k or IRA?

A 401(k) may provide an employer match, but an IRA does not. An IRA generally has more investment choices than a 401(k). An IRA allows you to avoid the 10% early withdrawal penalty for certain expenses like higher education, up to $10,000 for a first home purchase or health insurance if you are unemployed.

How do I protect my IRA from the market crash?

Protect Retirement Money from Market Volatility

- Maintain the Right Portfolio Mix.

- Diversification Helps.

- Have Some Cash on Hand.

- Be Disciplined About Withdrawals.

- Don't Let Emotions Take Over.

- The Bottom Line.

What are the disadvantages of an IRA?

Let's start with the Roth's disadvantages.

- You pay taxes upfront.

- The maximum contribution is low.

- You have to set it up yourself.

- There are income limits.

- Your savings grow tax-free.

- There's no need for required minimum distributions.

- You can withdraw your contributions.

- You get tax diversification in retirement.

Yet No Comments