secure act 10year rule

THE 10-YEAR RULE. One of the big changes in the SECURE Act was the elimination of the stretch IRA for most non-spouse beneficiaries. It was replaced with the “10-year rule,” which says the inherited IRA (or Roth IRA) funds must be withdrawn by the end of the 10-year period after the death of the IRA owner.

- How does the 10-year rule work?

- Can an eligible designated beneficiary use the 10-year rule?

- What are the new rules for inherited IRAs?

- Who are eligible beneficiaries under secure act?

- At what age does RMD stop?

- What is the 10 year rule for inherited IRAs?

- Are inherited IRAs grandfathered under secure act?

- Are grandchildren eligible designated beneficiaries?

- How does secure act affect beneficiaries?

- Is it better to inherit a Roth or traditional IRA?

- Do heirs pay taxes on ROTH IRAs?

- Do I have to take an RMD from an inherited IRA in 2020?

How does the 10-year rule work?

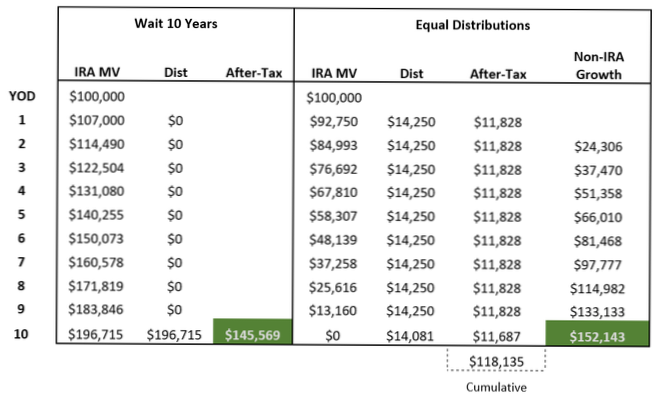

Starting in 2020, for IRAs passing to most non-spouse beneficiaries (not including minor children of the owner, chronically ill or disabled, those less than 10 years younger, and properly drafted “see-through” trusts), the entire IRA must be distributed by the end of the 10th year following the owner's death.

Can an eligible designated beneficiary use the 10-year rule?

Eligible designated beneficiaries do not have to use the 10-year rule, and may elect to take distributions over their single life expectancy.

What are the new rules for inherited IRAs?

Under the new law, non-spouse beneficiaries will have to withdraw all the funds in the inherited IRA within 10 years from the death of the original account owner. It applies to IRAs inherited after Dec. 31, 2019.

Who are eligible beneficiaries under secure act?

Any other person who is less than 10 years younger than the decedent. This is a catch-all that includes certain friends and siblings (depending on age), who are identified as beneficiaries of a retirement account.

At what age does RMD stop?

You reach age 70½ after December 31, 2019, so you are not required to take a minimum distribution until you reach 72. You reached age 72 on July 1, 2021. You must take your first RMD (for 2021) by April 1, 2022, with subsequent RMDs on December 31st annually thereafter.

What is the 10 year rule for inherited IRAs?

THE 10-YEAR RULE. One of the big changes in the SECURE Act was the elimination of the stretch IRA for most non-spouse beneficiaries. It was replaced with the “10-year rule,” which says the inherited IRA (or Roth IRA) funds must be withdrawn by the end of the 10-year period after the death of the IRA owner.

Are inherited IRAs grandfathered under secure act?

Beneficiaries who inherited IRAs before 2020 are grandfathered. They get to follow the old rules and continue to benefit from a Stretch IRA.

Are grandchildren eligible designated beneficiaries?

Grandchildren generally fall under the category of 'Designated Beneficiary,' which means that they can distribute the assets however they like, without RMDs each year—as long as all assets are distributed within 10 years.

How does secure act affect beneficiaries?

The SECURE Act's changes to the post-death rules for retirement account owners (IRA, 401(k), 403(b), etc.) will impact many beneficiaries who will have to distribute funds from their inherited account(s) within 10 years after the year of the account owner's death. ... as your IRA or 401(k) beneficiary.

Is it better to inherit a Roth or traditional IRA?

Conventional wisdom suggests that inheriting a Roth IRA is always better than inheriting a traditional IRA. ... “The basic rule for Roth IRA contributions/conversions remains true no matter who is making the withdrawal — the original owner or beneficiary,” says Spiegelman.

Do heirs pay taxes on ROTH IRAs?

If the deceased opened their first Roth IRA in 2016, 2017, 2018, 2019 or 2020, earnings would be taxable if distributed before the applicable five-year period is up.

Do I have to take an RMD from an inherited IRA in 2020?

The Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, waives required minimum distributions during 2020 for IRAs and retirement plans, including beneficiaries with inherited accounts. This waiver includes RMDs for individuals who turned age 70 ½ in 2019 and took their first RMD in 2020.

Yet No Comments