Your Paycheck Tax Withholdings and Payroll Deductions Explained

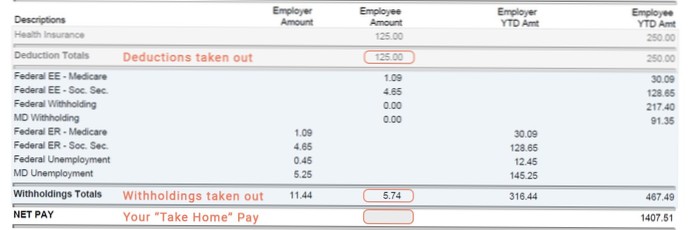

Withholdings are amounts taken out of every employees' paycheck to pay their income taxes for that pay period. Deductions are amounts taken out for benefits and donations the employee has chosen, such as retirement, healthcare, or special funds.

- What are payroll deductions and how do they impact your paycheck?

- What do the deductions mean on my paycheck?

- What is the relationship between payroll taxes and withholding?

- How do I calculate withholding and deductions from employee paychecks?

- What is the percentage of deductions of a paycheck?

- What are illegal payroll deductions?

- Are payroll deductions the same for all employees?

- Is health insurance taken out of every paycheck?

- How do I deduct health insurance premiums from my paycheck?

- What are the components of payroll tax?

- What taxes are deducted from payroll?

- Who pays payroll tax?

What are payroll deductions and how do they impact your paycheck?

There are a number of different payroll deductions that can be deducted from an employee's paycheck each pay period. These range from FICA taxes, contributions to a retirement or 401(k) plan, child support payments, insurance premiums, and uniform deductions.

What do the deductions mean on my paycheck?

Employers withhold (or deduct) some of their employees' pay in order to cover payroll taxes and income tax. Money may also be deducted, or subtracted, from a paycheck to pay for retirement or health benefits.

What is the relationship between payroll taxes and withholding?

Payroll tax uses a flat tax rate, meaning it is a percentage that you withhold from employee wages. Withhold 7.65% of each employee's gross wages from their pay. And, contribute a matching 7.65%. So, if an employee earns $500 per paycheck, you would withhold $38.25 ($500 X .

How do I calculate withholding and deductions from employee paychecks?

FICA Taxes - Who Pays What? Withhold half of the total (7.65% = 6.2% for Social Security plus 1.45% for Medicare) from the employee's paycheck. For the employee above, with $1,500 in weekly pay, the calculation is $1,500 x 7.65% (. 0765) for a total of $114.75.

What is the percentage of deductions of a paycheck?

The term “payroll taxes” refers to FICA taxes, which is a combination of Social Security and Medicare taxes. These taxes are deducted from employee paychecks at a total flat rate of 7.65 percent that's split into the following percentages: Medicare taxes – 1.45 percent. Social Security taxes – 6.2 percent.

What are illegal payroll deductions?

Some common payroll deductions often made by employers that are unlawful include: Gratuities. An employer cannot collect, take, or receive any gratuity or part thereof given or left for an employee, or deduct any amount from wages due an employee on account of a gratuity given or left for an employee.

Are payroll deductions the same for all employees?

In the US, federal and state incomes taxes are withheld from all employee paychecks. The amount withheld is determined by the number of exemptions an employee enters in their W-4 form when they're hired.

Is health insurance taken out of every paycheck?

If you sign up for your employer-provided health insurance, the cost will come out of your paycheck. ... Whatever amount you choose to contribute will be deducted from your paycheck as well.

How do I deduct health insurance premiums from my paycheck?

Most premiums are paid with pre-tax dollars, which means they are deducted from your wages before taxes are applied. Deducting them again as a medical expense would be "double-dipping." You can only deduct the premiums if your employer included them in Box 1 (Gross Wages) of your W-2.

What are the components of payroll tax?

Payroll taxes consist of Social Security and Medicare taxes. Social Security tax funds benefits for retirement, dependents of retired workers, and the disabled and their dependents. Medicare tax funds medical benefits for people once they reach age 65.

What taxes are deducted from payroll?

What are payroll deductions?

- Income tax.

- Social security tax.

- 401(k) contributions.

- Wage garnishments. ...

- Child support payments.

Who pays payroll tax?

That's $1.31 trillion out of $3.42 trillion. These taxes come from the wages, salaries, and tips that are paid to employees, and the government uses them to finance Social Security and Medicare. Employers withhold payroll tax on behalf of their employees and pay it directly to the government.

Yet No Comments