Why You Should Hire a Certified Financial Planner - Benefits

Develop a comprehensive plan that addresses your major areas of financial concern: retirement, college planning, insurance, avoiding estate tax, etc. Provide advice as unexpected financial issues arise in your life. Set up investment accounts and invest funds for you.

- Why is it important to hire a certified financial planner?

- Why you should choose a CFP?

- What can a certified financial planner do for me?

- Why you should hire a financial planner even if you're not rich?

- Why you should not use a financial advisor?

- Are financial planners worth it?

- Which is better CFA or CFP?

- How much does the CFP cost?

- How much does a CFP make?

- What is the difference between a financial planner and a financial advisor?

- How do I choose a Certified Financial Planner?

- How difficult is CFP exam?

Why is it important to hire a certified financial planner?

According to the CFP® Board, CFP® professionals “are trained to help you develop a comprehensive strategy to reach your short- and long-term financial goals … from planning for retirement to saving for college.” ... Only those who meet these rigorous requirements can call themselves CFP® professionals.

Why you should choose a CFP?

Working with a CFP® professional can help you find the path to achieving your financial goals. Your goals may evolve over the years as a result of shifts in your lifestyle or circumstances such as an inheritance, career change, marriage, house purchase or a growing family.

What can a certified financial planner do for me?

A certified financial planner (CFP) is an individual that has received a formal designation from the Certified Financial Planner Board of Standards, Inc. CFPs help individuals in a variety of areas in managing their finances, such as retirement, investing, education, insurance, and taxes.

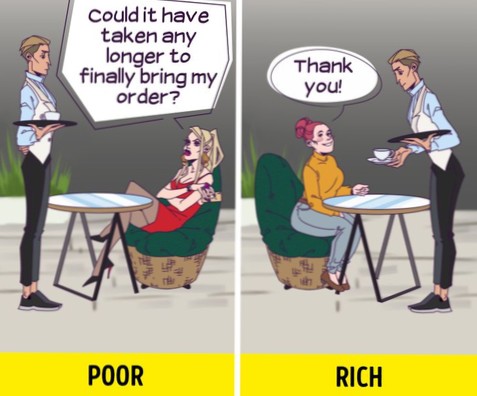

Why you should hire a financial planner even if you're not rich?

Financial planners can help clarify the process

While the average person can probably pay down credit cards, set up a Roth IRA and do some basic investing online, professionals can help streamline the nuances of financial planning.

Why you should not use a financial advisor?

Not only that, but by shirking responsibility for your own investments, you're also losing a lot of money in FEES. The fees you pay to a financial advisor may not seem like a lot, but it is a huge amount of money in the long-term. Even a 2% fee can wipe out a significant amount of your future wealth building.

Are financial planners worth it?

But if you're neglecting your finances, it's likely worth it to hire a wealth advisor. Time is money, and there's a cost to delaying good financial decisions or prolonging poor ones, like keeping too much cash or putting off doing an estate plan.

Which is better CFA or CFP?

CFAs typically work more in the field of financial analytics and investing, while CFPs usually focus on financial planning with individual clients. Keep in mind that getting a CFA is also a longer process with more exams.

How much does the CFP cost?

CFP® Exam Cost

The standard registration fee for the CFP® exam is $825, but there's an early bird rate of $725, which is available until six weeks before the registration deadline. There's a late registration fee of $925 for the two weeks before the registration deadline.

How much does a CFP make?

A mid-career, five- to 10- year certified financial planner can expect an average income of $80,000 a year, whereas a CFP that has more than 20 years of experience will have an average income of $140,000 per year.

What is the difference between a financial planner and a financial advisor?

A financial planner is a professional who helps companies and individuals create a program to meet long-term financial goals. Financial advisor is a broader term for those who help manage your money including investments and other accounts.

How do I choose a Certified Financial Planner?

- Do You Need a Financial Advisor? ...

- Decide What Services You Need. ...

- Select Which Type of Advisor You Want.

- Know the Difference Between a Fiduciary Financial Advisor and Nonfiduciary. ...

- Determine What You Can Afford. ...

- Ask for Referrals From Friends or Google. ...

- Check the Advisor's Credentials. ...

- Interview Multiple Advisors.

How difficult is CFP exam?

The certified financial planner exam is likely the hardest test you'll ever take, Dorsainvil says. “Think of the hardest exam you took in college then times it by 10.” Preparing to take the CFP exam begins months or even years before you actually sit to take the test.

Yet No Comments