What Is Supplemental Security Income - Benefits

- What is the difference between Social Security and Supplemental Security Income?

- Who is eligible for Supplemental Security Income?

- How much do you get for Supplemental Security Income?

- What is the SSI income limit for 2020?

- What is the most SSI will pay?

- What are the 3 main types of Social Security benefits?

- What conditions automatically qualify for SSI?

- What income is not counted for SSI?

- What disqualifies you from getting SSI?

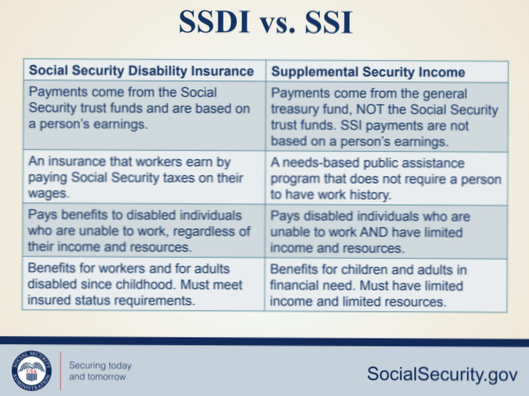

What is the difference between Social Security and Supplemental Security Income?

Unlike Social Security benefits, SSI benefits are not based on your prior work or a family member's prior work. ... SSI benefits are paid on the first of the month. To get SSI, you must be disabled, blind, or at least 65 years old and have "limited" income and resources.

Who is eligible for Supplemental Security Income?

Supplemental Security Income (SSI) is a federal program that provides monthly payments to people who have limited income and few resources. SSI is for people who are 65 or older, as well as for those of any age, including children, who are blind or who have disabilities.

How much do you get for Supplemental Security Income?

How Much Money Will I Receive From SSI Benefits? Currently, for California residents, the maximum SSI payment is $910.72 per month for an eligible individual living independently and $1532.14 per month for an eligible couple. For individuals who are legally blind the monthly benefit is $967.23.

What is the SSI income limit for 2020?

In general, the income limit for SSI is the federal benefit rate (FBR), which is $794 per month for an individual and $1,191 per month for a couple in 2021. Remember, though, that not all income is countable, and so you can earn more than $794 per month and still qualify for SSI (more on this below).

What is the most SSI will pay?

SSI amounts for 2021

The monthly maximum Federal amounts for 2021 are $794 for an eligible individual, $1,191 for an eligible individual with an eligible spouse, and $397 for an essential person.

What are the 3 main types of Social Security benefits?

The types are retirement, disability, survivors and supplemental benefits.

What conditions automatically qualify for SSI?

What Conditions Automatically Qualify You for Social Security Disability?

- Musculoskeletal problems, such as back conditions and other dysfunctions of the joints and bones.

- Senses and speech issues, such as vision and hearing loss.

- Respiratory illnesses, such as asthma and cystic fibrosis.

What income is not counted for SSI?

A couple can get SSI if they have unearned income of less than $1,211 a month in 2021. Because a larger portion of earned income isn't counted, a person who gets SSI can earn up to $1,673 a month ($2,467 for a couple) and still get SSI.

What disqualifies you from getting SSI?

Generally, the more countable income you have, the less your SSI benefit will be. If your countable income is over the allowable limit, you cannot receive SSI benefits. Some of your income may not count as income for the SSI program.

Yet No Comments