What Is Invoice Factoring - Pros

Improved Cash Flow and Working Capital - Instead of waiting for your customers to pay their invoices, invoice factoring provides immediate cash you can use to achieve your business objectives. Stop waiting 30, 60 or 90 days to get paid on your invoices.

- What are the benefits of factoring?

- What are the pros and cons of factoring?

- Why do we factor invoices?

- Why would a company use factoring?

- What is the disadvantages of factoring?

- What is factoring in simple words?

- How much does factoring invoices cost?

- Is invoice factoring a loan?

- What is the best factoring company?

- How do invoice factoring companies make money?

- Can I sell my invoices?

- Can I use 2 factoring companies?

What are the benefits of factoring?

Advantages of Factoring

- working capital optimization.

- credit protection against bad-debts, debtor insolvency and losses.

- reduction of your DSO (Days Sales Outstanding)

- increased debt capacity.

- transformation of fixed costs into variable costs.

- efficiency in sourcing new customers using up-to date credit information and experience.

What are the pros and cons of factoring?

What Are the Pros of Invoice Factoring?

- Immediate Cash Flow: When applying for business loans or other financing options, it can take months to be approved. ...

- Ongoing Cash Flow: ...

- Better Chance of Getting Approved: ...

- Ability to Outsource This Task: ...

- No Collateral Required: ...

- Improved Customer Relationships. ...

- The Cost: ...

- Liabilities:

Why do we factor invoices?

Invoice factoring pros

Fast cash: Invoice factoring can provide immediate working capital to help cover a funding gap caused by slow-paying customers. Improved cash flow: You can keep loyal customers on longer payment terms but still improve your cash flow to help you grow your business.

Why would a company use factoring?

The most common reason to use factoring is to improve cash flow due to slow-paying clients. ... Factoring their accounts receivable provides companies with immediate funds for their invoices. This funding eliminates the cash flow problem and provides the liquidity to meet payroll and cover other expenses.

What is the disadvantages of factoring?

Disadvantages of factoring

Due diligence – most providers will verify customer invoices to make sure that they are accurate and that customers are satisfied with the products and/or services. Concentration limits – factoring may be unsuitable for businesses that have one or two main customers.

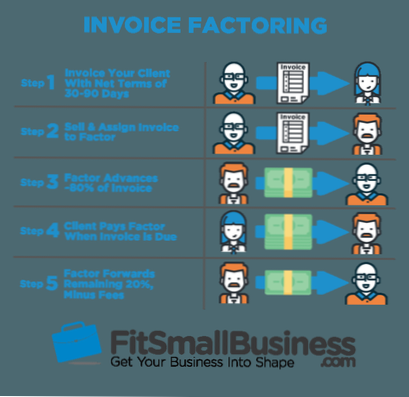

What is factoring in simple words?

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

How much does factoring invoices cost?

Typical Invoice Factoring Rates

A factoring company may charge 2% for the first 30 days and 0.5% for every 10 days that the invoice remains unpaid. Fees are often referred to as invoice discounting rates. Some factoring companies offer a flat fee structure where a one-time fee is charged up front.

Is invoice factoring a loan?

Invoice Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable (invoices) to a factoring company at a discount. Invoice factoring should not be considered a loan but a financing solution to keep your cash flow running.

What is the best factoring company?

The 4 Best Factoring Companies of 2021

- Best Overall: altLINE.

- Best for Invoice Management: Triumph Business Capital.

- Best for Trucking: RTS Financial.

- Best for Small Businesses: Paragon Financial.

How do invoice factoring companies make money?

How does a factoring company make money? When a business factors their invoices, the factor (or factoring company) advances up to 90% of the invoice value to the business. When the factor collects the full payment from the end customer, they return the remaining 10% to the business, minus a factoring fee.

Can I sell my invoices?

Many savvy businesses today opt to utilize their accounts receivable and sell unpaid invoice to finance their companies by: Selling their accounts receivable to a third party (known as factoring or invoice discounting). ... Borrowing cash using accounts receivable as collateral, a type of asset-financing arrangement.

Can I use 2 factoring companies?

By law, you can only have one factoring company at a time. You are not allowed to have more than one factor, since that becomes to difficult to determine who has first right to your company's invoices. ... So, before you can go about switching factoring companies, you must first arrange a buyout of the old factor.

Yet No Comments