What Is Deflation - Definition, Causes

Deflation is generally the decline in the prices for goods and services that occur when the rate of inflation falls below 0%. Deflation will take place naturally, if and when the money supply of an economy is limited.

- What is deflation and its causes?

- What causes inflation or deflation?

- What is deflation example?

- What is deflation in economics?

- What are the main causes of deflation?

- Is deflation good or bad?

- Who benefits deflation?

- What is better inflation or deflation?

- What should I invest in during deflation?

What is deflation and its causes?

Deflation, or negative inflation, happens when prices generally fall in an economy. This can be because the supply of goods is higher than the demand for those goods, but can also have to do with the buying power of money becoming greater.

What causes inflation or deflation?

Inflation occurs when the prices of goods and services rise, while deflation occurs when those prices decrease. The balance between these two economic conditions, opposite sides of the same coin, is delicate and an economy can quickly swing from one condition to the other.

What is deflation example?

Deflation can occur in recessions, where demand for most goods and services declines and the providers of these goods and services lower prices to compete for fewer consumer dollars. ... A recent example of deflation occurred during The Great Recession of 2007–2008, where the inflation rate fell below 0%.

What is deflation in economics?

Deflation Definition

Deflation is when consumer and asset prices decrease over time, and purchasing power increases. ... Compare this with inflation, which is the gradual increase in prices across the economy. While deflation may seem like a good thing, it can signal an impending recession and hard economic times.

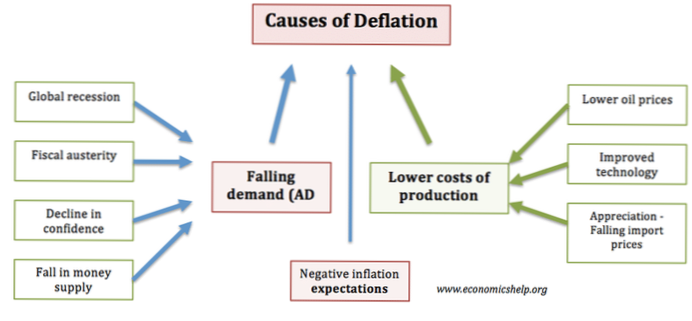

What are the main causes of deflation?

Causes of Deflation

- Fall in the money supply. A central bank. ...

- Decline in confidence. Negative events in the economy, such as recession, may also cause a fall in aggregate demand. ...

- Lower production costs. ...

- Technological advances. ...

- Increase in unemployment. ...

- Increase in the real value of debt. ...

- Deflation spiral.

Is deflation good or bad?

Understanding Deflation

1 When the index in one period is lower than in the previous period, the general level of prices has declined, indicating that the economy is experiencing deflation. This general decrease in prices is a good thing because it gives consumers greater purchasing power.

Who benefits deflation?

For the consumer, the lower prices may seem like a benefit, especially following a period of prolonged inflation or when wages are stagnant or falling. In a deflationary environment, those who have borrowed funds from lending institutions are now reluctant (or unable) to repay the money they borrowed.

What is better inflation or deflation?

Deflation is when the prices of goods and services fall. Deflation expectations make consumers wait for future lower prices. That reduces demand and slows growth. Deflation is worse than inflation because interest rates can only be lowered to zero.

What should I invest in during deflation?

Cash is not only the ultimate hedge, but also the only investment that rises in value during deflation. As stocks, bonds, real estate, and commodities are all losing value, the amount of cash required to purchase these assets is falling, by definition. In other words, the relative value of cash is going up.

Yet No Comments