What Is Compound Interest - Definition, Formulas

- What is the formula for calculating compound interest?

- What is the formula of compound interest with example?

- How do you explain compound interest?

- What is the formula of compound interest for Class 8?

- Can compound interest make you rich?

- What is the downside of compound interest?

- What is 8% compounded quarterly?

- Why is compound interest so powerful?

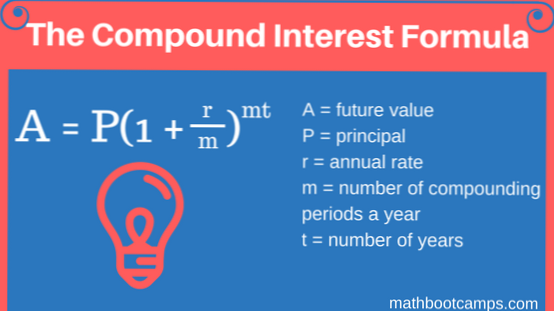

What is the formula for calculating compound interest?

The formula for compound interest is P (1 + r/n)^(nt), where P is the initial principal balance, r is the interest rate, n is the number of times interest is compounded per time period and t is the number of time periods.

What is the formula of compound interest with example?

Compound Interest Formula

| Time (in years) | Amount | Interest |

|---|---|---|

| 1 | P(1 + R/100) | \fracPR100 |

| 2 | P\left (1+\fracR100 \right )^2 | P(1 + R/100) (R/100) |

| 3 | P\left (1+\fracR100 \right )^3 | P(1 + R/100)2 (R/100) |

| 4 | P\left (1+\fracR100 \right )^4 | P(1 + R/100)3 (R/100) |

How do you explain compound interest?

Compound interest occurs when interest gets added to the principal amount invested or borrowed, and then the interest rate applies to the new (larger) principal. It's essentially interest on interest, which over time leads to exponential growth.

What is the formula of compound interest for Class 8?

Compound Interest Formula:

Amount = Principal (1+Rate100)time in years ---- if compounded annually. Compound Interest formula in Maths: Compound Interest = Final amount - Original amount.

Can compound interest make you rich?

It's your money making more money over time. Compound interest can grow your wealth because it is interest that's earned on top of interest already earned. This concept applies not just to the money saved in your bank account, but on returns earned on your investments too.

What is the downside of compound interest?

One of the drawbacks of taking advantage of compound interest options is that it can sometimes be more expensive than you realize. The cost of compound interest is not always immediately apparent and if you do not manage your investment closely, making interest payments can actually lose you money.

What is 8% compounded quarterly?

Account #3: Quarterly Compounding

The annual interest rate is restated to be the quarterly rate of i = 2% (8% per year divided by 4 three-month periods). The present value of $10,000 will grow to a future value of $10,824 (rounded) at the end of one year when the 8% annual interest rate is compounded quarterly.

Why is compound interest so powerful?

Compound Interest will make a deposit or loan grow at a faster rate than simple interest, which is interest calculated only on the principal amount. Not only are you getting interest on your initial investment, but you are getting interest on top of interest!

Yet No Comments