What Is a Ponzi Scheme - Bernie Madoff Scandal Explained

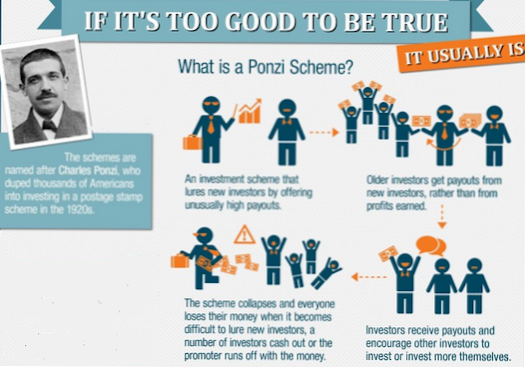

Madoff used a Ponzi scheme to lure investors in Ponzi schemes draw investors in by guaranteeing unusually high returns. The name originated with Charles Ponzi, a con artist who promised 50% returns on investments in only 90 days and ended up serving a 14-year prison sentence in 1920 due to his scheme.

- What is a Ponzi scheme simple explanation?

- How much is Bernie Madoff worth today?

- Who invented the pyramid scheme?

- Is Jamalife a pyramid scheme?

- What did Bernie Madoff do wrong?

- Who is Madoff Whistleblower?

- How much time did Bernie Madoff get?

- What was the first pyramid scheme?

- How much money did Madoff steal?

- What is the most famous pyramid scheme?

What is a Ponzi scheme simple explanation?

A Ponzi scheme is an investment fraud that pays existing investors with funds collected from new investors. Ponzi scheme organizers often promise to invest your money and generate high returns with little or no risk. ... Instead, they use it to pay those who invested earlier and may keep some for themselves.

How much is Bernie Madoff worth today?

Court filing reveals Madoff's net worth at least $823 million.

Who invented the pyramid scheme?

The term "Ponzi Scheme" was coined after a swindler named Charles Ponzi in 1919. However, the first recorded instances of this sort of investment scam can be traced back to the mid-to-late 1800s, and were orchestrated by Adele Spitzeder in Germany and Sarah Howe in the United States.

Is Jamalife a pyramid scheme?

Jamalife Helpers Global Ltd (JHG) located at www.jamalifehelpersglobal.com is a Ponzi or pyramid scheme. The fraudulent website tricks potential victims into registering by claiming they can experience so-called financial freedom and find financial prosperity.

What did Bernie Madoff do wrong?

As a well-respected financier, Madoff convinced thousands of investors to hand over their savings, falsely promising consistent profits in return. He was caught in December 2008 and charged with 11 counts of fraud, money laundering, perjury, and theft.

Who is Madoff Whistleblower?

Harry M. Markopolos (born October 22, 1956) is an American former securities industry executive and a forensic accounting and financial fraud investigator. From 1999 to 2008, Markopolos uncovered evidence that suggested that Bernie Madoff's wealth management business was a huge Ponzi scheme.

How much time did Bernie Madoff get?

On March 12, 2009, Madoff pleaded guilty to 11 federal crimes and admitted to operating the largest private Ponzi scheme in history. He was sentenced three months later to the maximum sentence: 150 years in prison with restitution of $170 billion.

What was the first pyramid scheme?

The first pyramid scheme is credited to Charles Ponzi, who in 1919 engineered a "top down" scam involving promissory notes payable in 90 days and a promise to repay investors, at 50% interest, who invested in the notes. ... Both scams reward the early scheme participants and penalize the late arrivals.

How much money did Madoff steal?

How much money did Madoff steal? At the time of Madoff's arrest, fake account statements were telling clients they had holdings worth $60 billion. More than $13 billion of an estimated $17.5 billion that investors put into Madoff's business has been recovered.

What is the most famous pyramid scheme?

The most famous Ponzi scheme in recent history—and the single largest fraud of investors in the United States—was orchestrated for more than a decade by Bernard Madoff, who defrauded investors in Bernard L. Madoff Investment Securities LLC.

Yet No Comments