What are Exchange-Traded Funds (ETFs)?

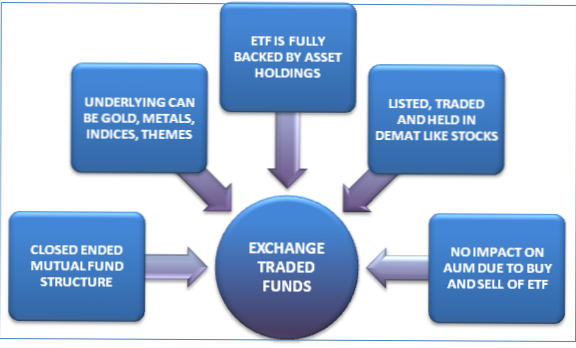

An exchange traded fund (ETF) is a type of security that tracks an index, sector, commodity, or other asset, but which can be purchased or sold on a stock exchange the same as a regular stock. ... ETFs can even be structured to track specific investment strategies.

- What are exchange traded funds and how do they work?

- What is the purpose of ETFs?

- What are the types of exchange traded funds?

- What is Exchange Traded Fund vs Mutual Fund?

- What is the downside of ETFs?

- Which ETF does Warren Buffett recommend?

- Are ETFs good for beginners?

- Is ETF safer than stocks?

- Do ETFs pay dividends?

- Are ETFs safe?

- Which ETF to buy now?

- When should I sell an ETF?

What are exchange traded funds and how do they work?

An ETF is a basket of securities, shares of which are sold on an exchange. They combine features and potential benefits of stocks, mutual funds, or bonds. Like individual stocks, ETF shares are traded throughout the day at prices that change based on supply and demand.

What is the purpose of ETFs?

Exchange-traded funds (ETFs) take the benefits of mutual fund investing to the next level. ETFs can offer lower operating costs than traditional open-end funds, flexible trading, greater transparency, and better tax efficiency in taxable accounts.

What are the types of exchange traded funds?

What are the Different Types of ETFs?

- Stock ETFs – these hold a particular portfolio of equities or stocks and are similar to an index. ...

- Index ETFs – these mimic a specific index, such as the S&P 500 Index. ...

- Bond ETFs – an exchange-traded fund that is specifically invested in bonds or other fixed-income securities.

What is Exchange Traded Fund vs Mutual Fund?

Mutual funds usually are actively managed to buy or sell assets within the fund in an attempt to beat the market and help investors profit. ETFs are mostly passively managed, as they typically track a specific market index; they can be bought and sold like stocks.

What is the downside of ETFs?

But there are also disadvantages to watch out for before placing an order to purchase an ETF. When it comes to diversification and dividends, the options may be more limited. And vehicles like ETFs that live by an index can also die by an index—with no nimble manager to shield performance from a downward move.

Which ETF does Warren Buffett recommend?

My recommendation is to go with the Vanguard FTSE All-World ex-US Small-Cap ETF, a fund that tracks the performance of the FTSE Global Small Cap ex US Index, which consists of over 3,000 stocks in dozens of countries.

Are ETFs good for beginners?

Exchange traded funds (ETFs) are ideal for beginner investors due to their many benefits such as low expense ratios, abundant liquidity, range of investment choices, diversification, low investment threshold, and so on.

Is ETF safer than stocks?

Exchange-traded funds come with risk just like stocks. While they tend to be seen as safer investments, some may still offer better than average gains, while others may not help investors see returns at all. ... Your personal tolerance for risk can be a big factor in deciding which might be the better fit for you.

Do ETFs pay dividends?

Exchange-traded funds (ETFs) pay out the full dividend that comes with the stocks held within the funds. To do this, most ETFs pay out dividends quarterly by holding all of the dividends paid by underlying stocks during the quarter and then paying them to shareholders on a pro-rata basis.

Are ETFs safe?

Most ETFs are actually fairly safe because the majority are indexed funds. ... While all investments carry risk and indexed funds are exposed to the full volatility of the market – meaning if the index loses value, the fund follows suit – the overall tendency of the stock market is bullish.

Which ETF to buy now?

Seven consumer cyclical ETFs to buy now:

- Consumer Discretionary Select Sector SPDR Fund (XLY)

- Vanguard Consumer Discretionary ETF (VCR)

- Invesco S&P 500 Equal Weight Consumer Discretionary ETF (RCD)

- SPDR S&P Homebuilders ETF (XHB)

- iShares U.S. Consumer Services ETF (IYC)

- SPDR S&P Retail ETF (XRT)

When should I sell an ETF?

If you have a substantial equity or fixed-income portfolio and want to protect against a drop in one or more stock or bond markets, selling short an ETF that includes a large number of stocks or bonds in the market or markets might be the way to go.

Yet No Comments