wells fargo platinum credit card limit increase

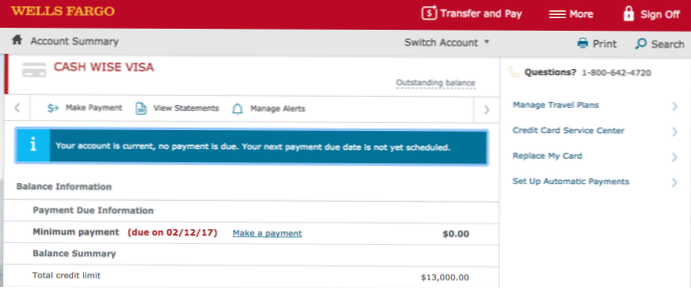

Here's the scoop on Wells Fargo Platinum credit limits: You can ask for an increase: To request a higher Wells Fargo credit card limit, call (800) 642-4720. Your odds of approval are highest if you pay your monthly bills on time and keep your credit utilization low.

- Does Wells Fargo automatically increase credit limit?

- How often does Wells Fargo increase your credit limit?

- How do I increase my credit card limit Wells Fargo?

- What is the daily limit on a Wells Fargo Platinum debit card?

- What is the highest credit limit for Wells Fargo Platinum Card?

- What is the highest credit card limit for Wells Fargo?

- What is the hardest credit card to get?

- What credit score is needed for a Wells Fargo Platinum Card?

- Is 10000 a good credit limit?

- Is Wells Fargo Platinum credit card good?

- Which bank gives the highest credit card limit?

- Can you have 2 Wells Fargo credit cards?

Does Wells Fargo automatically increase credit limit?

Automatic credit limit increases

In some cases, Wells Fargo might automatically increase your credit limit – without you having to request one. If you demonstrate a good payment history and are a reliable customer, the issuer will occasionally award you with more credit.

How often does Wells Fargo increase your credit limit?

Issuers tend not to extend automatic increases until you've had a card for at least six months. Similarly, if you recently received an increase on an existing account, expect to wait at least six to 12 months before you're considered for another increase, assuming you manage your account responsibly in the meantime.

How do I increase my credit card limit Wells Fargo?

To request to increase or decrease your card's daily dollar limits, contact us and we'll check on eligibility. To make the request, call the number on the back of your card, or talk to a banker at a Wells Fargo branch.

What is the daily limit on a Wells Fargo Platinum debit card?

What Is the Maximum Amount of Money I Can Withdraw at a Wells Fargo ATM? When you first open your Wells Fargo checking account and get a debit card, the daily withdrawal limit for your debit card will be set at $710.

What is the highest credit limit for Wells Fargo Platinum Card?

So to recap, your Wells Fargo Platinum credit limit will be $1,000+, and you could get an increase either by requesting one from Wells Fargo customer service at (800) 642-4720 or by moving your credit from another Wells Fargo card. That's as much as you'll know going in.

What is the highest credit card limit for Wells Fargo?

Editorial and user-generated content is not provided, reviewed or endorsed by any company. Wells Fargo credit card limits range from $500 for the Wells Fargo Cash Back College℠ Card to $5,000 for the Wells Fargo Visa Signature® Card, at a minimum. Other Wells Fargo cards fall somewhere in the middle.

What is the hardest credit card to get?

Centurion® Card from American Express

Why it's one of the hardest credit cards to get: The hardest credit card to get is the American Express Centurion Card. Known simply as the “Black Card,” you need an invitation to get Amex Centurion.

What credit score is needed for a Wells Fargo Platinum Card?

Compare to Other Cards

| Wells Fargo Platinum card | Citi® Diamond Preferred® Card | U.S. Bank Visa® Platinum Card |

|---|---|---|

| Recommended Credit Score 690850good - excellent | Recommended Credit Score 690850good - excellent | Recommended Credit Score 690850good - excellent |

Is 10000 a good credit limit?

You can't exactly predict a credit limit, but you can look at averages. Most creditworthy applicants with stable incomes can expect credit card credit limits between $3,500 and $7,500. High-income applicants with excellent credit might expect a credit limit of up to or more than $10,000.

Is Wells Fargo Platinum credit card good?

The Wells Fargo Platinum card is best for those looking for a basic card with no annual fee that gives you an extended interest-free period on balance transfers and purchases. You'll be able to pay down high-interest credit card debt or finance a big purchase without paying interest fees for 18 months.

Which bank gives the highest credit card limit?

Best High Limit Credit Cards of May 2021

| Card Name | Best For: | Credit Limit |

|---|---|---|

| Chase Sapphire Reserve® | Highest Limit | Credit limit from $10,000 |

| Chase Sapphire Preferred® Card | Overall | Credit limit from $5,000 |

| Wells Fargo Platinum card | Balance Transfers | Credit limit from $1,000 |

| Chase Freedom Unlimited® | 0% Purchases | Credit limit from $500 |

Can you have 2 Wells Fargo credit cards?

The Wells Fargo two-card combination makes it relatively easy to earn enough points for free flights, and a nice kicker is that flights booked through the Go Far Rewards portal have also always earned redeemable and elite qualifying miles for me over the last two years.

Yet No Comments