unbanked definition

"Unbanked" is an informal term for adults who do not use banks or banking institutions in any capacity. ... Unbanked persons also typically do not have insurance, pensions, or any other type of professional money-related services.

- What is the difference between unbanked and underbanked?

- Who is considered underbanked?

- Is unbanked a word?

- What is unbanked area?

- Why is it bad to be unbanked?

- Why would someone not have a bank account?

- How many people don't have a bank account in the world?

- Do lenders earn money by charging interest to borrowers?

- What are some of the financial services that the unbanked underbanked do not have access to?

- What is the opposite of underbanked?

- Who introduced financial inclusion?

What is the difference between unbanked and underbanked?

People who have a bank account but also tap into alternative financial services such as short-term payday loans, check-cashing services, and prepaid debit cards, are typically referred to as the underbanked. Some households are considered unbanked because they don't use banks or financial services at all.

Who is considered underbanked?

Households are generally designated as underbanked households if they've used alternative financing options during the previous years. This includes money orders and rent-to-own services and accounts for nearly 67 million Americans.

Is unbanked a word?

un·banked. adj. Not having or having never had a savings, checking, or other account with a bank. People who are unbanked.

What is unbanked area?

An 'Unbanked Rural Centre' (URC) is a rural (Tier 5 and 6) centre that does not have a CBS-enabled banking outlet of a Scheduled Commercial Bank, a Small Finance Bank, a Payment Bank or a Regional Rural Bank nor a branch of Local Area Bank or licensed Co-operative Bank for carrying out customer based banking ...

Why is it bad to be unbanked?

Unbanked households, which the FDIC defines as those that don't have an account at an insured institution, can't use savings accounts to build emergency funds and can't turn to time-saving tools for transactions such as paying bills and transferring money.

Why would someone not have a bank account?

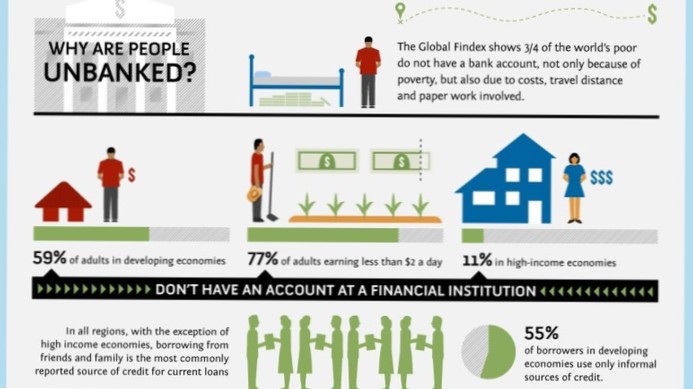

Some reasons a person might not have a bank account include: Lack of access via a nearby bank branch or mobile phone. Minimum balance fees. Distrust of the banking system.

How many people don't have a bank account in the world?

Globally, about 1.7 billion adults remain unbanked — without an account at a financial institution or through a mobile money provider.

Do lenders earn money by charging interest to borrowers?

Banks generally make money by borrowing money from depositors and compensating them with a certain interest rate. The banks will lend the money out to borrowers, charging the borrowers a higher interest rate, and profiting off the interest rate spread.

What are some of the financial services that the unbanked underbanked do not have access to?

Without a credit history, unbanked and underbanked individuals will not be able to access loans. ... Banks offer credit-building tools that are not available via alternative financial services. Many banks offer secured credit cards to their customers with no credit history or poor credit.

What is the opposite of underbanked?

A lot of people bank somewhere. Those who don't are "unbanked," and those who mostly don't are "underbanked": According to FDIC research, nearly 16 million American adults are unbanked; an additional 24.5 million are underbanked, reliant on services such as payday loans, cash advances and other "alternative" products.

Who introduced financial inclusion?

The concept of financial inclusion was first introduced in India in 2005 by the Reserve Bank of India. The objectives of financial inclusion are to provide the following: A basic no-frills banking account for making and receiving payments. Saving products (including investment and pension)

Yet No Comments