td cash secured credit card review

- Is TD Bank Secured Credit Card good?

- What credit score do you need for TD Cash credit card?

- Does TD Bank have a secured credit card?

- How long does it take to build credit with a secured credit card?

- Does secured visa build credit?

- Does a secured Mastercard build credit?

- What is the fastest way to build credit?

- Which credit bureau does TD Bank pull?

- Can you rent a car with a secured credit card?

- Why would you get denied for a secured credit card?

- Which secured credit card is the best to rebuild credit?

- What bank offer secured credit card?

Is TD Bank Secured Credit Card good?

The TD Cash Secured Credit Card is an excellent option, as it provides cash rewards with every purchase.

What credit score do you need for TD Cash credit card?

You need a credit scored of at least 750 to get approved for the TD Bank Cash card.

Does TD Bank have a secured credit card?

How to get a TD Cash Secured Credit Card. Apply online for the TD Cash Secured Credit Card. Once you're conditionally approved, visit a TD Bank near you to open a TD Simple Savings account. Bring a minimum of $300 to fund the security deposit.

How long does it take to build credit with a secured credit card?

Once you have opened a secured credit card, it takes about 30-45 days for the account to be reported to the credit bureaus, which is when your credit score actually starts building.

Does secured visa build credit?

You can often get approved for a secured credit card when you can't get approved for a traditional credit card. ... A secured credit card can help you establish or re-establish your credit. Since payments are included in your credit report, paying on time and managing your balance will help improve your credit score.

Does a secured Mastercard build credit?

Unlike a prepaid card, a secured card is an actual credit card that reports to the three major credit bureaus—providing the opportunity to build your credit, with responsible use. Prepaid cards are more like debit cards and cannot help you build your credit because they do not report to the major credit bureaus.

What is the fastest way to build credit?

- Pay bills on time.

- Make frequent payments.

- Ask for higher credit limits.

- Dispute credit report errors.

- Become an authorized user.

- Use a secured credit card.

- Keep credit cards open.

- Mix it up.

Which credit bureau does TD Bank pull?

TD. TD will usually pull your Experian credit report.

Can you rent a car with a secured credit card?

Yes, you can rent a car with a secured credit card. But to rent a car with a secured card, you need to have enough available credit to accommodate the hold that the rental agency will put on your card. ... There are ways to rent a car without a credit card, too. You could use a debit card or prepaid card, for example.

Why would you get denied for a secured credit card?

The most common reasons people are denied for a secured credit card include having a bankruptcy or tax lien on their credit report, not having enough income to meet their monthly obligations, and having an extremely low credit score.

Which secured credit card is the best to rebuild credit?

The Best Secured Credit Cards

- OpenSky® Secured Visa® Credit Card. ...

- Secured Mastercard® from Capital One® * ...

- Discover it® Secured Credit Card. ...

- Citi® Secured Mastercard® ...

- Green Dot primor® Visa® Gold Secured Credit Card. ...

- UNITY® Visa Secured Credit Card. ...

- U.S. Bank Secured Visa® Card * ...

- BankAmericard® Secured credit card *

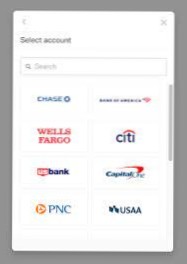

What bank offer secured credit card?

Banks That Offer Secured Credit Cards

- Bank of America.

- Capital One.

- Citi.

- Discover.

- USAA (Visa and Amex)

- U.S. Bank.

- Wells Fargo.

Yet No Comments