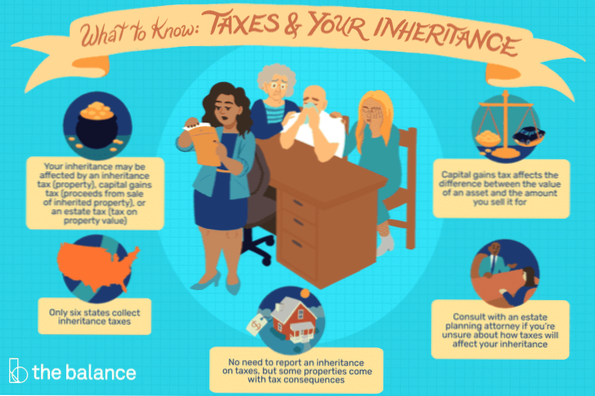

tax implications of inheritance

Inheritances are not considered income for federal tax purposes, whether you inherit cash, investments or property. ... Any gains when you sell inherited investments or property are generally taxable, but you can usually also claim losses on these sales.

- Do you have to report inheritance money to IRS?

- Do you have to pay taxes on money received as a beneficiary?

- What amount of inheritance is not taxable?

- How much money can you inherit before you have to pay taxes on it UK?

- How does IRS find out about inheritance?

- Does the IRS know when you inherit money?

- What do you do if you inherit money?

- How much can you inherit without paying taxes in 2019?

- How can I avoid paying inheritance tax?

Do you have to report inheritance money to IRS?

You won't have to report your inheritance on your state or federal income tax return because an inheritance is not considered taxable income. But the type of property you inherit might come with some built-in income tax consequences.

Do you have to pay taxes on money received as a beneficiary?

Beneficiaries generally don't have to pay income tax on money or other property they inherit, with the common exception of money withdrawn from an inherited retirement account (IRA or 401(k) plan). ... The good news for people who inherit money or other property is that they usually don't have to pay income tax on it.

What amount of inheritance is not taxable?

While federal estate taxes and state-level estate or inheritance taxes may apply to estates that exceed the applicable thresholds (for example, in 2021 the federal estate tax exemption amount is $11.7 million for an individual), receipt of an inheritance does not result in taxable income for federal or state income tax ...

How much money can you inherit before you have to pay taxes on it UK?

HMRC allows you to give up to £3,000 away each year to family and friends, tax-free. This amount is called the annual exemption. You can deduct these amounts from the value of your estate, which means no inheritance tax is due on them.

How does IRS find out about inheritance?

The IRS will monitor and review her income tax return each year, to determine whether the taxpayers have the capability to be placed on an installment payment arrangement. When she gets the inheritance, she would have to report the income for that tax year.

Does the IRS know when you inherit money?

Money or property received from an inheritance is typically not reported to the Internal Revenue Service, but a large inheritance might raise a red flag in some cases. When the IRS suspects that your financial documents do not match the claims made on your taxes, it might impose an audit.

What do you do if you inherit money?

What to Do With a Large Inheritance

- Think Before You Spend.

- Pay Off Debts, Don't Incur Them.

- Make Investing a Priority.

- Splurge Thoughtfully.

- Leave Something for Your Heirs or Charity.

- Don't Rush to Switch Financial Advisors.

- The Bottom Line.

How much can you inherit without paying taxes in 2019?

The Internal Revenue Service announced today the official estate and gift tax limits for 2019: The estate and gift tax exemption is $11.4 million per individual, up from $11.18 million in 2018.

How can I avoid paying inheritance tax?

How to avoid inheritance tax

- Make a will. ...

- Make sure you keep below the inheritance tax threshold. ...

- Give your assets away. ...

- Put assets into a trust. ...

- Put assets into a trust and still get the income. ...

- Take out life insurance. ...

- Make gifts out of excess income. ...

- Give away assets that are free from Capital Gains Tax.

Yet No Comments