SunTrust Secured Credit Card Review

- Is SunTrust secured credit card good?

- Does SunTrust offer a secured credit card?

- What credit score is needed for a SunTrust credit card?

- Which bank is best for secured credit card?

- What bank offer secured credit card?

- Does BB&T have secured credit cards?

- Can you be denied a secured credit card?

- Can you get a credit card with a 550 credit score?

- How often does SunTrust increase credit limit?

- What FICO score does SunTrust use?

- What credit score do you need for LightStream?

- What bank helps build credit?

Is SunTrust secured credit card good?

While the SunTrust secured credit card is a solid one, the fact that it has a $32 annual fee and a $300 minimum deposit keep it out of the running for a best-in-class secured credit card. You could easily find another secured credit card that offers cash back without an annual fee.

Does SunTrust offer a secured credit card?

The SunTrust Secured Credit Card with Cash Rewards is a secured credit card that earns cash rewards. Like other secured credit cards, the SunTrust Secured Credit Card with Cash Rewards requires a security deposit to establish the account.

What credit score is needed for a SunTrust credit card?

Most SunTrust credit cards require at least good credit, which is a credit score of at least 700. However, the SunTrust Secured Card is available for applicants who do not meet that criteria.

Which bank is best for secured credit card?

Best Secured Credit Cards

- OpenSky® Secured Visa® Credit Card: Best with No Credit Check Required.

- Secured Mastercard® from Capital One®: Best for Credit Newbies.

- Discover it® Secured Credit Card: Best Secured Credit Card Overall.

- Citi® Secured Mastercard®: Best Basic Card with No Annual Fee.

What bank offer secured credit card?

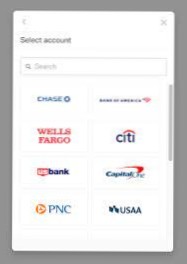

Banks That Offer Secured Credit Cards

- Bank of America.

- Capital One.

- Citi.

- Discover.

- USAA (Visa and Amex)

- U.S. Bank.

- Wells Fargo.

Does BB&T have secured credit cards?

Whether you need to establish or rebuild credit, secured credit cards from BB&T can help you reach your goals.

Can you be denied a secured credit card?

The most common reasons people are denied for a secured credit card include having a bankruptcy or tax lien on their credit report, not having enough income to meet their monthly obligations, and having an extremely low credit score.

Can you get a credit card with a 550 credit score?

The best credit card for a 550 credit score is the OpenSky® Secured Visa® Credit Card. There's no credit check when you apply, so approval is almost guaranteed. You just need $200 for a refundable security deposit and enough income to make monthly payments.

How often does SunTrust increase credit limit?

Suntrust offers most Suntrust business card holders a spending limit increase after about a year of responsible payment activity. So, you can wait for the 12-month mark, or you can take matters into your own hands at any time by calling Suntrust's customer service department and requesting one.

What FICO score does SunTrust use?

Editorial and user-generated content is not provided, reviewed or endorsed by any company. SunTrust will use TransUnion and/or Equifax for approval.

What credit score do you need for LightStream?

Minimum credit score: 690. Several years of credit history; excellent-credit borrowers have at least five, according to LightStream. Multiple account types within your credit history, like credit cards, a car loan or other installment loan and a mortgage.

What bank helps build credit?

The Citi® Secured Mastercard® is a no annual fee credit card that helps you build your credit when used responsibly. Unlike a debit card, it helps build your credit history with monthly reporting to all 3 major credit bureaus.

Yet No Comments