still haven't received my tax refund 2020

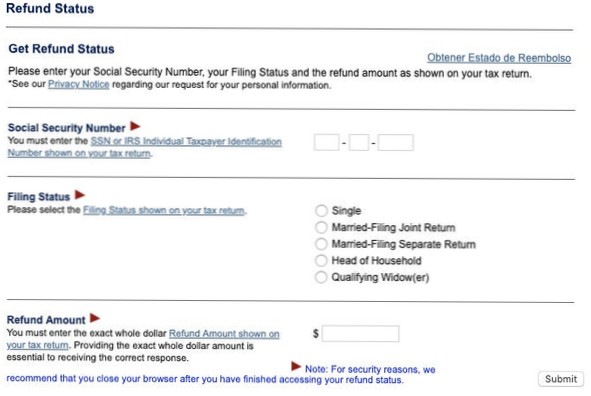

If you don't receive your refund in 21 days, your tax return might need further review. ... It's best to avoid contacting the IRS directly unless the Where's My Refund tool prompted you to do so or it's been 21 days since you filed your tax return electronically – or six weeks since you mailed your paper tax return.

Is there a delay in tax refunds for 2020?

A review by the IRS means that taxpayers will wait longer for refund cash for many 2020 tax returns. H&R Block notes on its website: "If your return meets these criteria, the IRS will manually review your return, and it may take an additional 10 to 14 business days to receive your refund."

What is still processing IRS 2020?

If your tax return status is "Still Being Processed" your tax return could be essentially on hold until the IRS corrects any issues and/or gets the additional information from you to continue processing your return.

Yet No Comments