Secured vs. Unsecured Debt - What's the Difference?

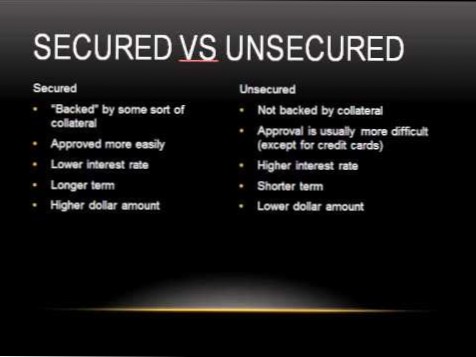

Unsecured debt has no collateral backing. Lenders issue funds in an unsecured loan based solely on the borrower's creditworthiness and promise to repay. Secured debts are those for which the borrower puts up some asset as surety or collateral for the loan.

- Is it better to have a secured or unsecured loan?

- Do I have to pay back unsecured debt?

- Is unsecured debt bad?

- What are examples of secured debt?

- What are the advantages of a unsecured loan?

- Do you get your money back from a secured loan?

- Can I go to jail for not paying an unsecured loan?

- Can you go to jail for not paying unsecured debt?

- Why you should never pay a collection agency?

Is it better to have a secured or unsecured loan?

A secured loan is normally easier to get, as there's less risk to the lender. ... That means a secured loan, if you can qualify for one, is usually a smarter money management decision vs. an unsecured loan. And a secured loan will tend to offer higher borrowing limits, enabling you to gain access to more money.

Do I have to pay back unsecured debt?

An unsecured loan is a loan that is not secured by other funds or property. In most instances, the only thing backing the loan is your pledge to pay it back. The most common type of unsecured loan is a credit card.

Is unsecured debt bad?

Unsecured loans don't involve any collateral. Common examples include credit cards, personal loans and student loans. ... For that reason, unsecured loans are considered a higher risk for lenders. You'll generally need a strong credit history and a higher score to qualify for an unsecured loan.

What are examples of secured debt?

The two most common examples of secured debt are mortgages and auto loans. This is so because their inherent structure creates collateral. If an individual defaults on their mortgage payments, the bank can seize their home. Similarly, if an individual defaults on their car loan, the lender can seize their car.

What are the advantages of a unsecured loan?

The main advantages of an unsecured loan include:

- You don't have to leverage any of your assets to secure funds.

- Your loan approval may be completed faster because there are no assets to evaluate.

- Unsecured loans may be a better option for borrowing smaller amounts.

Do you get your money back from a secured loan?

This means that when you apply for a secured loan, the lender will want to know which of your assets you plan to use. The lender will then place a lien on that asset until the loan is repaid in full. If you default on the loan payments, the lender can claim the collateral and sell it to recoup the loss.

Can I go to jail for not paying an unsecured loan?

Loan defaulter will not go to jail: Defaulting on loan is a civil dispute. Criminal charges cannot be put on a person for loan default. It means, police just cannot make arrests. Hence, a genuine person, unable to payback the EMI's, must not become hopeless.

Can you go to jail for not paying unsecured debt?

You cannot go to jail for not paying a loan. No creditor of consumer debt — including credit cards, medical debt, a payday loan, mortgage or student loans — can force you to be arrested, jailed or put in any kind of court-ordered community service. If you get sued for an unpaid debt, you'll end up in civil court.

Why you should never pay a collection agency?

If the creditor reported you to the credit bureaus, your strategy has to be different. Ignoring the collection will make it hurt your score less over the years, but it will take seven years for it to fully fall off your report. Even paying it will do some damage—especially if the collection is from a year or two ago.

Yet No Comments