Preferred Stock vs. Common Stock - What's the Difference?

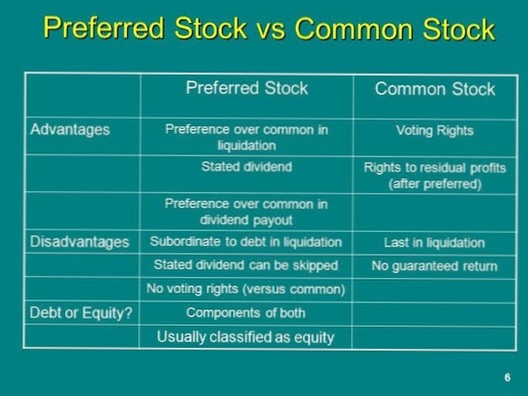

The main difference between preferred and common stock is that preferred stock gives no voting rights to shareholders while common stock does. Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders.

- Why would you buy preferred stock?

- Is preferred stock more risky than common stock?

- What is the downside of preferred stock?

- What are the advantages and disadvantages of common stock and preferred stock?

- Who buys preferred stock?

- Why you should avoid preferred stocks?

- Can preferred stock be sold?

- Can preferred stock be converted to common stock?

- How do preferred stocks work?

- What does 6% preferred stock mean?

- What are the pros and cons of preferred stock?

- When should you invest in preferred stock?

Why would you buy preferred stock?

Most shareholders are attracted to preferred stocks because they offer more consistent dividends than common shares and higher payments than bonds. However, these dividend payments can be deferred by the company if it falls into a period of tight cash flow or other financial hardship.

Is preferred stock more risky than common stock?

Preferred stock is a hybrid security that integrates features of both common stocks and bonds. Preferred stock is less risky than common stock, but more risky than bonds.

What is the downside of preferred stock?

Disadvantages of preferred shares include limited upside potential, interest rate sensitivity, lack of dividend growth, dividend income risk, principal risk and lack of voting rights for shareholders.

What are the advantages and disadvantages of common stock and preferred stock?

One of the advantages of preferred stock is lower risk. In the event a company runs into trouble and is forced to liquidate, preferred stockholders are paid first after debts obligations are met. Preferred stock is also less volatile than common stock but still offers the chance of equity growth.

Who buys preferred stock?

For individual retail investors, the answer might be "for no very good reason." It's not generally known, but most preferred shares are purchased by institutional investors at the time the company first goes public because they have an incentive to buy preferred shares that individual retail investors do not: the so- ...

Why you should avoid preferred stocks?

There are some other reasons to consider avoiding preferred stocks. ... Also, the typical lengthy maturity of preferred issues increases credit risk. Many companies might present modest credit risk in the near term, but their credit risk increases over time and tends to show up at the wrong time.

Can preferred stock be sold?

Preferred stocks, like bonds, pay a routine prearranged payment to investors. However, more like stocks and unlike bonds, companies may suspend these payments at any time. ... The company that sold you the preferred stock can usually, but not always, force you to sell the shares back at a predetermined price.

Can preferred stock be converted to common stock?

Convertible preferred stock can be converted to common shares at the conversion ratio. The conversion ratio is set by the company before the preferred stock is issued. For example, one preferred stock may be converted into two, three, four, and so on, common shares.

How do preferred stocks work?

Preferreds are issued with a fixed par value and pay dividends based on a percentage of that par, usually at a fixed rate. Just like bonds, which also make fixed payments, the market value of preferred shares is sensitive to changes in interest rates. ... Like bonds, preferreds are senior to common stock.

What does 6% preferred stock mean?

For example, 6% preferred stock means that the dividend equals 6% of the total par value of the outstanding shares. ... Except in unusual instances, no voting rights exist. Types include cumulative preferred stockand participating preferred stock.

What are the pros and cons of preferred stock?

The Pros and Cons of Buying Preferred Stock ETFs

Higher dividends: Compared to common stock, preferred stock will generally pay greater dividends. 3 Preference in bankruptcy: Preferred stocks are ahead of common stocks (but behind bonds) in order of liquidation if there is a bankruptcy proceeding.

When should you invest in preferred stock?

If you want to get higher and more consistent dividends, then a preferred stock investment may be a good addition to your portfolio. While it tends to pay a higher dividend rate than the bond market and common stocks, it falls in the middle in terms of risk, Gerrety said.

Yet No Comments