longterm care annuity providers

- Can you use an annuity to pay for long-term care?

- How does a long-term care annuity work?

- How much do long-term care annuities cost?

- What is an annuity with a long-term care rider?

- How much does a 100000 annuity pay per month?

- Who should not buy an annuity?

- What are the disadvantages of an annuity?

- Is long-term care insurance worth it 2020?

- Why would you recommend an annuity for long-term care fees?

- Does Medicare pay for long-term care?

- What is the best long-term care insurance?

- How long do you pay long-term care premiums?

Can you use an annuity to pay for long-term care?

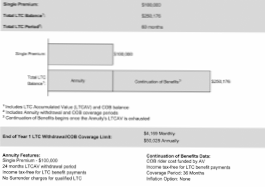

You buy an annuity with a lump sum and can use double or triple the premium amount as your long-term-care benefit. A $100,000 investment could provide up to $200,000 or $300,000 in long-term-care benefits. If you choose the $200,000 coverage with a four-year benefit period, the monthly benefit would be $4,200.

How does a long-term care annuity work?

How Does a Long-Term Care Annuity Work? A deferred long-term care annuity is available to people up to the age of 85. You pay an insurance company a single premium payment in exchange for regular monthly income for a designated period of time.

How much do long-term care annuities cost?

You may find it easier to pay the $3,490 per year (on average for a couple in their 60s) in LTC insurance premiums, according to 2018 data from the American Association for Long-Term Care Insurance, than try to scrape together a larger sum to purchase an LTC annuity.

What is an annuity with a long-term care rider?

Annuities with Long-Term Care Benefits

Normally, the annuity pays one monthly benefit amount. But if you ever need long-term care, the annuity starts paying out a higher monthly benefit that's a multiple of the premiums you've paid.

How much does a 100000 annuity pay per month?

A $100,000 Annuity would pay you $472 per month for the rest of your life if you purchased the annuity at age 65 and began taking your monthly payments in 30 days.

Who should not buy an annuity?

You should not buy an annuity if Social Security or pension benefits cover all of your regular expenses, you're in below average health, or you are seeking high risk in your investments.

What are the disadvantages of an annuity?

Annuity distributions are taxed as ordinary income, which is a higher rate than that for the capital gains you get from other retirement accounts. Annuities charge a hefty 10% early withdrawal fee if you take money out before age 59½.

Is long-term care insurance worth it 2020?

Experts say three to five years' worth of coverage is a good bet. On average, women need services longer than men — 3.7 years for women and 2.2 years for men. Women accounted for nearly two-thirds of all long-term care insurance claims paid in 2018, according to AALTCI.

Why would you recommend an annuity for long-term care fees?

Your annuity company can give you the money to use as needed or reimburse you after the fact for long-term care expenses you've already paid. To activate the long-term care rider and begin receiving benefits from the annuity, you generally have to meet medical standards that necessitate long-term care.

Does Medicare pay for long-term care?

Medicare doesn't cover long-term care (also called Custodial care), if that's the only care you need. Most nursing home care is custodial care.

What is the best long-term care insurance?

The 5 Best Long-Term Care Insurance of 2021

- Best Overall: New York Life.

- Best for Discounts: Mutual of Omaha.

- Best for No Waiting Period: Lincoln Financial Group.

- Best for Flexible Options: Pacific Life.

- Best for Easy Benefits Payout: Brighthouse Financial.

How long do you pay long-term care premiums?

It takes time to process your claim and many insurance policies include waiting periods—called elimination periods—after the claim is made before they'll actually pay out. Under most policies, you'll have to pay for long-term care services yourself for 30, 60, or even 90 days before your insurer starts reimbursing you.

Yet No Comments