Life Insurance Inside of Trusts

Trusts can help sidestep inheritance tax By writing a life-insurance policy in trust, the proceeds from the policy can be paid directly to the beneficiaries rather than to your legal estate, and will therefore not be taken into account when inheritance tax is calculated.

- Should you put life insurance in a trust?

- What does it mean to put life insurance in trust?

- How do you put a life insurance policy into a trust?

- How much does a life insurance trust cost?

- Can I leave my life insurance to anyone?

- What are the disadvantages of a trust?

- How does a life insurance trust work?

- Should I put mortgage protection trust?

- Does beneficiary override trust?

- Can a trustee be a beneficiary of a life insurance policy?

- Can you be a trustee and a beneficiary?

Should you put life insurance in a trust?

Life Insurance Beneficiaries

In most cases, it makes better sense to name your beneficiaries individually on life insurance policies versus naming a trust as beneficiary. ... Trusts are not considered individuals; therefore, life insurance proceeds paid to trusts are generally subjected to estate tax.

What does it mean to put life insurance in trust?

Putting your life insurance policy in trust involves a legal arrangement that helps to ensure that the money from that policy is used exactly as you intended, regardless of the value of your estate. ... It also means that your beneficiaries will receive the money much quicker, whether a will has been written or not.

How do you put a life insurance policy into a trust?

To put your life insurance into a trust, you'll need to select trustees, find an insurance provider, and decide on whether you want to place life insurance into the trust immediately or assign it to the trust at a later date.

How much does a life insurance trust cost?

The cost to set up irrevocable trusts through a major law firm runs between $2,000 and $5,000, primarily because the permanency of such a trust and the amount of upfront work and thought that must go into getting it right the first time.

Can I leave my life insurance to anyone?

The only real restriction is for minors, as you would need to designate a trust or legal guardian as the beneficiary to provide them the death benefit. While you can name anyone as a beneficiary, just make sure to notify them and provide them with a copy of your life insurance policy.

What are the disadvantages of a trust?

Drawbacks of a Living Trust

- Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. ...

- Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. ...

- Transfer Taxes. ...

- Difficulty Refinancing Trust Property. ...

- No Cutoff of Creditors' Claims.

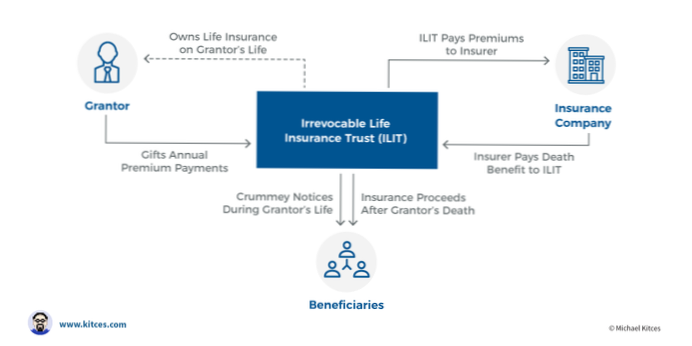

How does a life insurance trust work?

The insurance trust owns your life insurance policy. The trust holds the insurance policy with you as the named insured and when you die, the insurance benefit is paid to the trust.

Should I put mortgage protection trust?

To protect the insurance proceeds from this, you can write the policy into a trust. The trust ensures that the proceeds of the mortgage life insurance go to the Person Insured's intended beneficiaries. ... With the trust, the insurance proceeds will be paid more quickly and directly to the lender.

Does beneficiary override trust?

Some states, by statue or case law, hold that only the beneficiary named in the beneficiary designation form is entitled to these assets, regardless of whether your will, trust or other document specifically identifies the account and names someone else as its beneficiary.

Can a trustee be a beneficiary of a life insurance policy?

Can a beneficiary be a trustee for a life insurance trust? You may wish to place your life insurance policy in a trust and appoint either a legal professional or trusted friend/family member to disburse the proceeds according to your wishes.

Can you be a trustee and a beneficiary?

A settlor or trustee can also be a beneficiary of same trust. ... The trustee may be a person or an entity such as a company (typically when management fees are charged). The settlor may appoint multiple trustees. Although the trustees of a trust may change, a trust must always have at least one trustee.

Yet No Comments