investment farm fafsa

- What is an investment farm on fafsa?

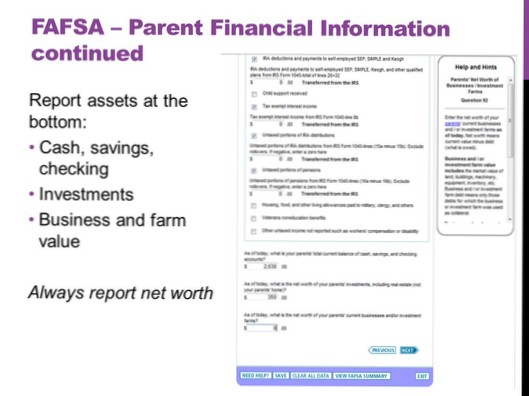

- What investments are reported on fafsa?

- Do investments affect fafsa?

- Do you have to report investments on fafsa?

- What is net worth on fafsa?

- What is an investment farm?

- Can fafsa check bank accounts?

- How much savings is too much for fafsa?

- Is it OK to skip asset questions on fafsa?

- Will fafsa know if I lie?

- What assets are not included in fafsa?

- How can I reduce my income for fafsa?

What is an investment farm on fafsa?

Farmland that you own but is farmed or rented by someone else would be considered an investment farm, and the net worth would be reported on the FAFSA. If you have a question regarding whether or not your farm is a family farm, contact the financial aid office at your college.

What investments are reported on fafsa?

Investments include real estate (don't include the home in which you live), rental property (includes a unit within a family home that has its own entrance, kitchen, and bath rented to someone other than a family member), trust funds, Uniform Gifts to Minors Act (UGMA) and Uniform Transfers to Minors Act (UTMA) ...

Do investments affect fafsa?

Any interest, dividends or capital gains reported on the student's income tax return is also counted as income on the FAFSA and assessed at 50 percent*.

Do you have to report investments on fafsa?

Investments must be reported on the FAFSA and PROFILE regardless of any voluntary restrictions on the use of the investment. When you list the prepaid tuition plan, report its refund value from the plan's most recent statement. All prepaid tuition plans send statements to the account owners at least once a year.

What is net worth on fafsa?

This is question 89 on the paper Free Application for Federal Student Aid (FAFSA®) form. The net worth of your parents' current investments is the amount left over after deducting the debt from the value of each investment.

What is an investment farm?

An investment farm is an agricultural business operation that is purchased and operated with the intention of making a profit, or with the goal of creating a tax deduction for the owner. ... Investment farms are owned by investors who typically do not live on the farm or take part in any day-to-day operations.

Can fafsa check bank accounts?

FAFSA doesn't check anything, because it's a form. However, the form does require you to complete some information about your assets, including checking and savings accounts. ... If your FAFSA is picked for verification, you may have to provide documentation proving the amounts you entered for bank accounts was accurate.

How much savings is too much for fafsa?

Less than 6 percent of those assets are viewed as potentially useable by the FAFSA. Generally speaking, savings will potentially reduce how much you receive in financial aid.

Is it OK to skip asset questions on fafsa?

Can I Skip FAFSA Questions about Assets? You can only skip FAFSA questions about assets if you meet the qualifications to do so based on your answers to other questions on the application. However, that's only because your asset information at that point doesn't affect your eligibility for federal student aid.

Will fafsa know if I lie?

You lose the money. If you received student financial aid because of lying on the FAFSA, you must return it. ... The Inspector General at the Department of Education will be alerted to your fraud after a school audits your FAFSA.

What assets are not included in fafsa?

Assets don't include

- the home in which your parents live;

- UGMA and UTMA accounts for which your parents are the custodian, but not the owner;

- the value of life insurance;

- ABLE accounts; and.

- retirement plans (401[k] plans, pension funds, annuities, noneducation IRAs, Keogh plans, etc.).

How can I reduce my income for fafsa?

Thankfully, there are smart, law-abiding strategies to keep your EFC low and accurate.

- Maximize Household Size. The larger your household size is, the lower your EFC will be (in most cases). ...

- Increase College Attendance Among Family Members. ...

- Wait Until the FAFSA Considers You Independent.

Yet No Comments