Investing for Cash Flow - Building a More Diversified Investment Portfolio

- What investment portfolio is most diversified?

- What is the best investment for cash flow?

- Do diversified portfolios perform better?

- Is it good to have a diverse stock portfolio?

- What are the dangers of over diversifying your portfolio?

- What does a good investment portfolio look like?

- How much money do I need to invest to make $3000 a month?

- How can I double my money?

- What are the 7 streams of income?

- What is the KISS rule of investing?

- Can a portfolio be too diversified?

- What does a balanced portfolio look like?

What investment portfolio is most diversified?

A mutual fund or index fund provides more diversification than an individual security. They track a bundle of stocks, bonds, or commodities.

What is the best investment for cash flow?

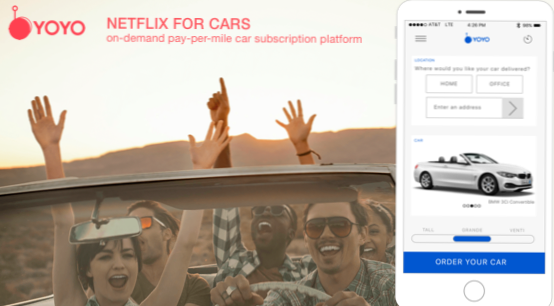

Investing for Cash Flow – Building a More Diversified Investment Portfolio

- Real Estate.

- Your Business.

- Buy a Business.

- P2P Lending.

- Dividend Stocks.

Do diversified portfolios perform better?

Diversification has a number of benefits for you as an investor, but one of the largest is that it can actually improve your potential returns and stabilize your results. By owning multiple assets that perform differently, you reduce the overall risk of your portfolio, so that no single investment can hurt you.

Is it good to have a diverse stock portfolio?

It is a management strategy that blends different investments in a single portfolio. The idea behind diversification is that a variety of investments will yield a higher return. It also suggests that investors will face lower risk by investing in different vehicles.

What are the dangers of over diversifying your portfolio?

Financial-industry experts also agree that over-diversification—buying more and more mutual funds, index funds, or exchange-traded funds—can amplify risk, stunt returns, and increase transaction costs and taxes.

What does a good investment portfolio look like?

A good investment portfolio generally includes a range of blue chip and potential growth stocks, as well as other investments like bonds, index funds and bank accounts.

How much money do I need to invest to make $3000 a month?

By this calculation, to get $3,000 a month, you would need to invest around $108,000 in a revenue-generating online business. Here's how the math works: A business generating $3,000 a month is generating $36,000 a year ($3,000 x 12 months).

How can I double my money?

Here are some options to double your money:

- Tax-free Bonds. Initially tax- free bonds were issued only in specific periods. ...

- Kisan Vikas Patra (KVP) ...

- Corporate Deposits/Non-Convertible Debentures (NCD) ...

- National Savings Certificates. ...

- Bank Fixed Deposits. ...

- Public Provident Fund (PPF) ...

- Mutual Funds (MFs) ...

- Gold ETFs.

What are the 7 streams of income?

7 Different Types of Income Streams

- Active and Passive Income Streams.

- Diversification.

- Earned Income.

- Profit Income.

- Interest Income.

- Dividend Income.

- Rental Income.

- Capital Gains Income.

What is the KISS rule of investing?

What is the KISS rule? Keep it simple, stupid. -means successful investments are ones that are simple. Avoid complicated investments that are difficult to understand or explain.

Can a portfolio be too diversified?

Over diversification is possible as some mutual funds have to own so many stocks (due to the large amount of cash they have) that it's difficult to outperform their benchmarks or indexes. Owning more stocks than necessary can take away the impact of large stock gains and limit your upside.

What does a balanced portfolio look like?

Typically, balanced portfolios are divided between stocks and bonds, either equally or tilted to 60% stocks and 40% bonds. Balanced portfolios may also maintain a small cash or money market component for liquidity purposes.

Yet No Comments