how to solve financial crisis in a country

5 Tips to Overcome a Financial Crisis

- Identify the Problems. The first step to overcoming financial crisis is to identify the primary problem that is causing difficulties. ...

- Create a Budget. One of the best ways to deal with financial problems is creating a budget plan. ...

- Set Financial Priorities. ...

- Address the Problem. ...

- Develop a Plan and Track Progress.

- How can a country avoid financial crisis?

- How can we solve financial crisis?

- What are three things countries can do to minimize the probability of being hit by a severe international financial crisis?

- What saved the 2008 recession?

- What is the solution for recession?

- What role does the IMF play in financial crisis?

- What is an international financial crisis?

- How does the financial crisis affect developing countries?

- Who is to blame for the Great Recession of 2008?

- Did people lose money 2008?

- What was the root cause of the global financial crisis in 2008?

How can a country avoid financial crisis?

To avoid crises, a country needs both sound macroeconomic policies and a strong financial system. A sound macroeconomic policy framework is one that promotes growth by keeping inflation low, the budget deficit small, and the current account sustainable.

How can we solve financial crisis?

Do the proper maintenance on everything from your home to your health to avoid expensive problems down the road.

- Maximize Your Liquid Savings. ...

- Make a Budget. ...

- Prepare to Minimize Your Monthly Bills. ...

- Closely Manage Your Bills. ...

- Take Stock of Your Non-Cash Assets and Maximize Their Value. ...

- Pay Down Your Credit Card Debt.

What are three things countries can do to minimize the probability of being hit by a severe international financial crisis?

Countries can minimize the likelihood of a severe international financial crisis by adopting and maintaining credible and sustainable fiscal and monetary policies.

What saved the 2008 recession?

1 By September 2008, Congress approved a $700 billion bank bailout, now known as the Troubled Asset Relief Program. By February 2009, Obama proposed the $787 billion economic stimulus package, which helped avert a global depression. Here is an overview of the significant moments of the Great Recession of 2008.

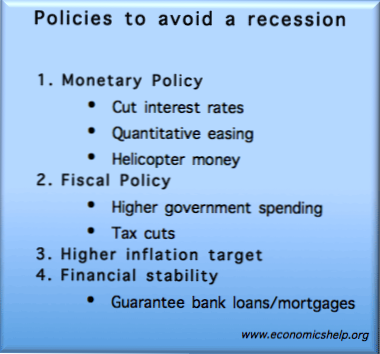

What is the solution for recession?

To avoid a recession, the government and monetary authorities need to try and increase aggregate demand (consumer spending, investment, exports). There is no guarantee that they will work. It will depend on the policies and also the causes of the recession.

What role does the IMF play in financial crisis?

The IMF helps member countries facing economic crisis by offering loans, technical assistance, and surveillance of economic policies. Money to fund the IMF's activities comes from member countries that pay a quota based on the size of each country's economy and its importance in world trade and finance.

What is an international financial crisis?

The global financial crisis (GFC) refers to the period of extreme stress in global financial markets and banking systems between mid 2007 and early 2009. ... Many banks around the world incurred large losses and relied on government support to avoid bankruptcy.

How does the financial crisis affect developing countries?

The current financial crisis started in developed countries, but reduced foreign investment and reduced demand for imports of commodities and labour-intensive products are having profound effects on developing countries.

Who is to blame for the Great Recession of 2008?

For both American and European economists, the main culprit of the crisis was financial regulation and supervision (a score of 4.3 for the American panel and 4.4 for the European one).

Did people lose money 2008?

It would be a massive understatement to say that 2008 had a few folks who lost big in the stock market. The year was full of sob stories, from homeowners being forced out, to everyday investors seeing their 401(k)s shrink, to millions of Americans losing their jobs.

What was the root cause of the global financial crisis in 2008?

The financial crisis was primarily caused by deregulation in the financial industry. That permitted banks to engage in hedge fund trading with derivatives. Banks then demanded more mortgages to support the profitable sale of these derivatives. ... That created the financial crisis that led to the Great Recession.

Yet No Comments