How to Open A Sub Account Using Capital One 360

How to Open A Sub Account Under An Existing Capital One 360 Account

- Log in to your Capital One 360.

- Click “My Accounts” at top of the page. There will be a drop-down box. ...

- Select the type of account you want to open. ...

- Give the account a nickname. ...

- Fund the account. ...

- Confirm the new account. ...

- View your new account.

- Does Capital One allow sub accounts?

- Can I have multiple Capital One 360 checking accounts?

- Can I open a Capital One 360 account for my child?

- What is a sub share account?

- Which is better ally or Capital One 360?

- Is there a difference between Capital One and Capital One 360?

- How do I deposit cash into Capital One 360?

- Is Capital One 360 a good checking account?

- How do I add money to my Capital One 360 savings account?

- What is the best account to open for a child?

- What banks allow minors to open accounts?

- Is Capital One Kids Savings Account good?

Does Capital One allow sub accounts?

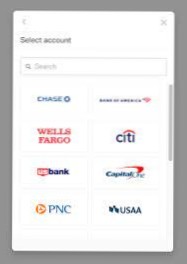

If you don't have a savings account that allows sub-savings (or if you don't have one at all), that's okay! You simply need to open one up. Here are a few great suggestions for banks that offer great savings accounts (with sub-savings): Capital One 360 / ING Direct (This is the one I use)

Can I have multiple Capital One 360 checking accounts?

You can have up to three separate 360 Checking accounts. If this is your first 360 Checking account, you're requesting that we automatically issue a debit card (the "Card") to you, and we'll automatically link each additional 360 Checking account to the debit card.

Can I open a Capital One 360 account for my child?

While this checking account is designed for teenagers, any child age 8+ can be a joint account holder with their parent or legal guardian. Once they turn 18, your teen can choose to open a 360 Checking account and transfer their balance from their MONEY account.

What is a sub share account?

A Sub Share Account allows you to save for something specific, or separate your finances into separate Sub Shares on the same account – paying taxes, insurance, a new car, car repairs, vacation, or a new home, etc.

Which is better ally or Capital One 360?

Capital One 360: Certificates of deposit. ... Both have competitive APYs across the board, but Ally's are a bit better, and it offers more CD types. Ally has an 11-month no-penalty CD and two Raise Your Rate options that let you increase your APY if the bank's rates go up.

Is there a difference between Capital One and Capital One 360?

Capital One 360 is the online banking branch of Capital One. They're part of the same holding company, but different "banks." Part of the way 360 retains such good terms is because they're online-only. They don't have the overhead of the standard Capital One bank with physical branches.

How do I deposit cash into Capital One 360?

- Open up the Capital One® mobile app. Sign in and tap your checking or savings account.

- Make a Deposit. Select the Deposit icon.

- Snap a picture of your check (front & back) Show it a little love with good lighting, a dark background, and a view of all 4 corners. ...

- Give us the details of your deposit. ...

- That's it — wrap it up.

Is Capital One 360 a good checking account?

Overall bank rating

The bottom line: Capital One 360 offers a top-of-the-line bank experience with strong customer support. Its checking and savings accounts also earn solid rates and don't charge monthly fees.

How do I add money to my Capital One 360 savings account?

Just fill out our Direct Deposit Form to get started. Link an external account to your 360 Checking to make adding and moving money even simpler. Tell your check to say “cheese” and deposit it in seconds with the Capital One Mobile app.

What is the best account to open for a child?

Best Savings Accounts for Kids Under Age 18

- Alliant Credit Union Kids Savings Account. 0.55% Yield on All Balances Above $100; Open to Kids Under Age 13. ...

- Capital One 360 Kids Savings Account. 0.30% Yield on All Balances; No Age Limit to Open. ...

- PNC Bank 'S' is for Savings® Account. Robust Educational Suite.

What banks allow minors to open accounts?

What Are the Top 10 Checking Accounts for Teens?

- Account Considerations.

- Capital One.

- Wells Fargo.

- Chase Bank.

- Union Bank & Trust.

- USAA.

- Alliant Credit Union.

- Citizen's Bank.

Is Capital One Kids Savings Account good?

A kid-friendly account with grown-up features. So they can save just like you. A 0.30% APY that'll make them feel all grown up and keep their account balance growing even faster.

...

Move their savings to the top of the class.

| Account Balance | Annual Percentage Yield (APY) |

|---|---|

| All balances | 0.30% |

Yet No Comments