How to Calculate Credit Card Interest That You Owe (APR)

For example, if you currently owe $500 on your credit card throughout the month and your current APR is 17.99%, you can calculate your monthly interest rate by dividing the 17.99% by 12, which is approximately 1.49%. Then multiply $500 x 0.0149 for an amount of $7.45 each month.

- How do you calculate interest on a credit card balance?

- How do you calculate monthly interest from APR?

- What is 24% APR on a credit card?

- How do you calculate interest owed?

- How much interest is charged on a credit card?

- Why did I get charged interest on my credit card after I paid it off?

- What's the difference between APR and interest rate?

- What is a good APR rate?

- What is a good APR for a loan?

- Is 24.99 Apr good?

- Is a 26.99 Apr good?

- How can I avoid paying APR on my credit card?

How do you calculate interest on a credit card balance?

3. Calculate your interest charges. Now that you found both your average daily balance and daily rate, you can calculate your interest charges. This can be done by multiplying your average daily balance by the daily rate, then multiplying that amount by the number of days in your billing cycle.

How do you calculate monthly interest from APR?

To convert an annual interest rate to monthly, use the formula "i" divided by "n," or interest divided by payment periods. For example, to determine the monthly rate on a $1,200 loan with one year of payments and a 10 percent APR, divide by 12, or 10 ÷ 12, to arrive at 0.0083 percent as the monthly rate.

What is 24% APR on a credit card?

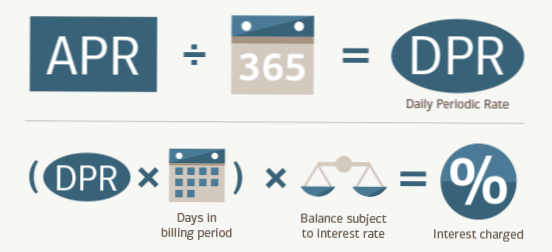

If you have a credit card with a 24% APR, that's the rate you're charged over 12 months, which comes out to 2% per month. Since months vary in length, credit cards break down APR even further into a daily periodic rate (DPR). It's the APR divided by 365, which would be 0.065% per day for a card with 24% APR.

How do you calculate interest owed?

Simple interest

Gather information like your principal loan amount, interest rate and total number of months or years that you'll be paying the loan. Calculation: You can calculate your total interest by using this formula: Principal Loan Amount x Interest Rate x Time (aka Number of Years in Term) = Interest.

How much interest is charged on a credit card?

To calculate a credit card's interest rate, just divide the APR by 365 (days in a year). This will tell you how much interest you'll be charged every day when you carry a balance from month to month. For example, if your APR is 15%, you'll be charged interest on your outstanding balance at a daily rate of 0.41%.

Why did I get charged interest on my credit card after I paid it off?

I paid off my entire bill when it was due last month and still got charged interest. ... This means that if you have been carrying a balance, you will be charged interest – sometimes called “residual interest” – from the time your bill was sent to you until the time your payment is received by your card issuer.

What's the difference between APR and interest rate?

An annual percentage rate (APR) is a broader measure of the cost of borrowing money than the interest rate. The APR reflects the interest rate, any points, mortgage broker fees, and other charges that you pay to get the loan. For that reason, your APR is usually higher than your interest rate.

What is a good APR rate?

A good APR for a credit card is 14% and below. That's roughly the average APR among credit card offers for people with excellent credit. And a great APR for a credit card is 0%. The right 0% credit card could help you avoid interest entirely on big-ticket purchases or reduce the cost of existing debt.

What is a good APR for a loan?

A good APR on a personal loan ranges between 3.99% and 11%. The lowest APR on a personal loan is around 3.99%. And the average APR for a personal loan is around 11%, according to the Federal Reserve. You'll likely only be able to get rates close to 3.99% if you have excellent credit.

Is 24.99 Apr good?

Is 24.99 Apr good? Yes, I would consider 24.99% a high interest rate. The average rate is around 19.9% but it is possible to get a lower rate if you have a good credit rating.

Is a 26.99 Apr good?

A good APR for a first credit card is anything below 20%. The best low interest first time credit card is the Bank of America® Cash Rewards Credit Card for Students because it offers introductory APRs of 0% for 15 months on purchases and 0% for 15 months on balance transfers, with a regular APR of 13.99% - 23.99% (V).

How can I avoid paying APR on my credit card?

Pay off your balance every month.

Avoid paying interest on your credit card purchases by paying the full balance each billing cycle. Resist the temptation to spend more than you can pay for any given month, and you'll enjoy the benefits of using a credit card without interest charges.

Yet No Comments