hold strategy in bcg matrix

4 Strategies of BCG Matrix

- 1) Build. By increasing investment, the product is given an impetus such that the product increases its market share. ...

- 2) Hold. The company cannot invest or it has other investment commitments due to which it holds the product in the same quadrant. ...

- 3) Harvest. ...

- 4) Divest.

- Which strategy is suitable for dog quadrant in BCG matrix?

- What is the ideal strategy for a question mark in BCG matrix?

- Which of the following strategies is the best for star as suggested in BCG matrix?

- What strategy should be pursued for a question mark in the BCG matrix and why?

- What are the four categories of BCG matrix?

- What does the dog symbolize in BCG matrix?

- What does symbolize in BCG matrix?

- What do cash cows symbolize in BCG matrix?

- What are the advantages of BCG matrix?

- What are the elements of the BCG matrix?

- How do you analyze the BCG matrix?

- Is BCG matrix still relevant?

Which strategy is suitable for dog quadrant in BCG matrix?

Question mark products: As the name suggests, it's not known if they will become a star or drop into the dog quadrant. These products often require significant investment to push them into the star quadrant. The challenge is that a lot of investment may be required to get a return.

What is the ideal strategy for a question mark in BCG matrix?

The strategy for products that have been designated as a question mark must either be focused on growth (to turn the product into a star) or on cost savings (to turn the product into a cash cow). An example that can be considered as a 'Question mark' in the BCG Matrix is the tablet from Philips.

Which of the following strategies is the best for star as suggested in BCG matrix?

Therefore the appropriate strategies for 'Stars' are those which protect existing market share and result in increased volume supply into the market, e.g. product enhancements, improved distribution, cost efficiencies etc. When the market growth rate slows, 'Stars' should become the business's 'Cash Cow' products.

What strategy should be pursued for a question mark in the BCG matrix and why?

What strategy should be pursued for a "question mark" in the BCG Matrix, and why? A question mark in the BCG matrix has a low market share in a high-growth industry. This means that there is a lot of upside potential, but for now it is uncertain whether or not you will be able to capitalize on it.

What are the four categories of BCG matrix?

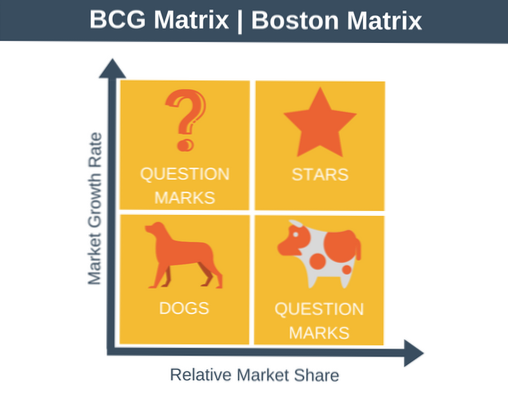

The BCG growth-share matrix contains four distinct categories: "dogs," "cash cows," "stars," and “question marks.”

What does the dog symbolize in BCG matrix?

What Is a Dog? A dog is one of the four categories or quadrants of the BCG Growth-Share matrix developed by Boston Consulting Group in the 1970s to manage different business units within a company. A dog is a business unit that has a small market share in a mature industry.

What does symbolize in BCG matrix?

Solution(By Examveda Team)

Question mark symbolize Remain Diversified in BCG matrix. The BCG growth-share matrix is used to help the company decide what it should keep, sell, or invest more in. The BCG growth-share matrix breaks down products into four categories: dogs, cash cows, stars, and “question marks.”

What do cash cows symbolize in BCG matrix?

Cash Cows symbolize Stable in BCG matrix. Cash cows are the leaders in the marketplace and generate more cash than they consume. These are business units or products that have a high market share but low growth prospects.

What are the advantages of BCG matrix?

The advantages of the Boston Matrix include: » It provides a high-level way to see the opportunities for each product in your portfolio. » It enables you to think about how to allocate your limited resources to the portfolio so that profit is maximized over the long-term. » It shows if your portfolio is balanced.

What are the elements of the BCG matrix?

The elements of the BCG matrix are stars, question marks, cash cows, and dogs. 5. Identify three grand strategies and give examples of each. Three grand strategies are growth strategy, stability strategy, and retrenchment strategy.

How do you analyze the BCG matrix?

- Choose the unit. BCG matrix can be used to analyze SBUs, separate brands, products or a firm as a unit itself. ...

- Define the market. Defining the market is one of the most important things to do in this analysis. ...

- Calculate relative market share. ...

- Find out market growth rate. ...

- Draw the circles on a matrix.

Is BCG matrix still relevant?

The matrix remains relevant today—but with some important tweaks. A Changing Business Environment Since the introduction of the matrix, conglomerates have become less common and the business environment has become more dynamic and unpredictable. Market share is now less of a driver of and surrogate for advantage.

Yet No Comments