Compound Annual Growth Rate (CAGR) Calculation and Examples

- How do you calculate CAGR annual growth rate?

- How do you calculate compound growth rate?

- How do I calculate 3 year CAGR in Excel?

- What is a 3 year CAGR?

- How do I calculate growth rate?

- How do I calculate average growth rate?

- What does 5 year CAGR mean?

- How do you calculate a 5% increase?

- What is compound annual growth rate used for?

How do you calculate CAGR annual growth rate?

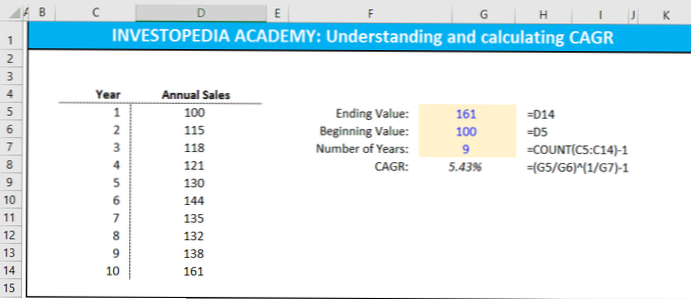

To calculate the CAGR of an investment:

- Divide the value of an investment at the end of the period by its value at the beginning of that period.

- Raise the result to an exponent of one divided by the number of years.

- Subtract one from the subsequent result.

How do you calculate compound growth rate?

- You may calculate CAGR using the formula: CAGR = (Ending Investment Value) / (Beginning Investment Value) ^ (1/n) -1. ...

- You may calculate CAGR using the ClearTax CAGR Calculator. ...

- CAGR shows you the smoothened average annual return earned by your investment each year.

How do I calculate 3 year CAGR in Excel?

Note: in other words, to calculate the CAGR of an investment in Excel, divide the value of the investment at the end by the value of the investment at the start. Next, raise this result to the power of 1 divided by the number of years. Finally, subtract 1 from this result.

What is a 3 year CAGR?

The Sales 3 Year Compound Annual Growth Rate, or CAGR, measures the growth rate in sales over the longer run.

How do I calculate growth rate?

How to calculate growth rate using the growth rate formula? The basic growth rate formula takes the current value and subtracts that from the previous value. Then, this difference is divided by the previous value and multiplied by 100 to get a percentage representation of the growth rate.

How do I calculate average growth rate?

Annual Average Growth Rate = [(Growth Rate)y + (Growth Rate)y+1 + … (Growth Rate)y+n] / N

- Growth Rate (y) – Growth rate in year 1.

- Growth Rate (y + 1) – Growth rate in the next year.

- Growth Rate (y + n) – Growth rate in the year “n”

- N – Total number of periods.

What does 5 year CAGR mean?

Price CAGR 5y

The 5 Year Compound Annual Growth Rate measures the average / compound annualised growth of the share price over the past five years. It is calculated as Current Price divided by Old Price to the power of a 5th, multiplied by 100.

How do you calculate a 5% increase?

I am working to increase pricing by 5%. If the price is 100, I would typically use the formulas 100 * 1.05 = 105, which is a $5 increase. An associate suggests I divide to get the desired increase. For example, using $100 with a 5 percent increase.

What is compound annual growth rate used for?

Compound annual growth rate, or CAGR, is the mean annual growth rate of an investment over a specified period of time longer than one year. It represents one of the most accurate ways to calculate and determine returns for individual assets, investment portfolios, and anything that can rise or fall in value over time.

Yet No Comments