CD Rates - Compare Top Rates for 2021

Summary of Best 1-year CD rates for May 2021

- Quontic Bank: 0.65% APY.

- Comenity Direct: 0.63% APY.

- BrioDirect: 0.60% APY.

- First Internet Bank of Indiana: 0.60% APY.

- Limelight Bank: 0.60% APY.

- Live Oak Bank: 0.60% APY.

- Ally Bank: 0.55% APY.

- Marcus by Goldman Sachs: 0.55% APY.

- Are CD rates going up in 2021?

- Will money market rates increase in 2021?

- Are CDs worth it 2020?

- Who has the best 12 month CD rates?

- Who has the best jumbo CD rates?

- Are there any 3% CD rates?

- Why are CD rates so low?

- Should I lock my mortgage rate today?

- Where can I get the best interest rate on my money?

Are CD rates going up in 2021?

CD rates should stay low in 2021

Online banks typically pay higher interest rates on CDs than national brick-and-mortar banks. Online CD rates went down in 2020, but they probably won't decrease much more in 2021, because they need to pay higher rates to compete with large banks like Chase or Bank of America.

Will money market rates increase in 2021?

Expect the top-yielding savings and money market account rates to end 2021 a little higher than they did in 2020 but not by much. ... That's because the Federal Reserve is planning to keep rates near zero through at least 2023.

Are CDs worth it 2020?

What To Consider Before Investing In CDs in 2020. CDs are beneficial for those who have an excess amount of savings and want to invest in something low-risk. CDs have been around since the early periods of banking, and other investment options have come into existence since then.

Who has the best 12 month CD rates?

NerdWallet's Best 1-Year CD Rates May 2021

- TAB Bank CD: 0.50% APY.

- Discover Bank CD: 0.50% APY.

- Synchrony Bank CD: 0.50% APY.

- Connexus Credit Union CD: 0.55% APY.

- Ally Bank High Yield CD: 0.55% APY.

- Marcus by Goldman Sachs High-Yield CD: 0.55% APY.

- Live Oak Bank CD: 0.60% APY.

- Quontic Bank CD: 0.65% APY.

Who has the best jumbo CD rates?

Our guide to the highest jumbo CD rates available to anyone in the U.S.

| BEST NATIONAL JUMBO CDs | ||

|---|---|---|

| Best 2-Year Jumbo CDs | Rate | Minimum |

| Superior Choice Credit Union | 0.90% APY | $100,000 |

| Kinecta Federal Credit Union | 0.75% APY | $100,000 |

| Nuvision Federal Credit Union | 0.75% APY | $100,000 |

Are there any 3% CD rates?

Best 3-Year CD Rates:

- Abound Credit Union - 1.25% APY.

- Lafayette Federal Credit Union - 1.01% APY.

- USAlliance Federal Credit Union - 1.00% APY.

- MAC Federal Credit Union - 1.00% APY.

- Evansville Teachers Federal Credit Union - 0.95% APY.

- Hiway Federal Credit Union - 0.95% APY.

- TruStone Financial Credit Union- 0.90% APY.

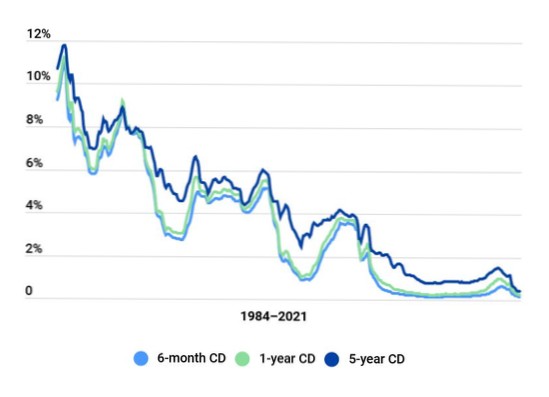

Why are CD rates so low?

CD rates are declining

CD rates are influenced by interest rate moves by the Federal Reserve. The U.S. central bank's key rate has been pegged at zero percent since March 2020 in an effort to stimulate the economy during the COVID-19 crisis, and subsequently, CD rates are low.

Should I lock my mortgage rate today?

Locking in your interest rate can be tempting, here's why: Mortgage rates could rise after you lock. The threat of a higher mortgage interest rate can be a strong reason to lock in a rate that you're comfortable with. Peace of mind.

Where can I get the best interest rate on my money?

- Open a high-yield savings or checking account. If your bank is paying anywhere near the "average" savings account interest rate, you're not earning enough. ...

- Join a credit union. ...

- Take advantage of bank welcome bonuses. ...

- Consider a money market account. ...

- Build a CD ladder. ...

- Invest in a money market mutual fund.

Yet No Comments