Asset Allocation - How to Diversify Your Investment Portfolio to Maximize Return and Minimize Risk

How to diversify your portfolio

- Step 1: Ensure your portfolio has many different investments. ETFs & mutual funds. ...

- Step 2: Diversify within individual types of investments. Pick investments with different rates of returns. ...

- Step 3: Consider investments with varying risk. ...

- Step 4: Rebalance your portfolio regularly.

- How can a diversified portfolio help maximize returns?

- How do you maximize return and minimize risk?

- How can you minimize the risk from your investments?

- Does portfolio diversification reduce return?

- What are the dangers of over diversifying your portfolio?

- What is the average annual return if someone invested 100% in bonds?

- What is the best way to maximize return in a portfolio while minimizing risk?

- How do you maximize portfolio returns?

- What does maximize returns mean?

- Which kind of investment probably has a higher return?

- How can you minimize any risk you may have from investing in bonds?

- Which is the safest way to invest money?

How can a diversified portfolio help maximize returns?

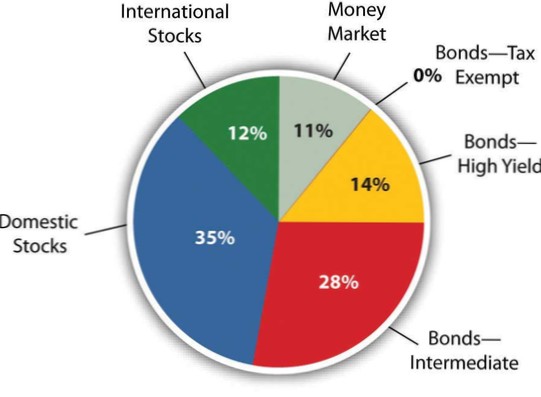

Diversification is a technique that reduces risk by allocating investments across various financial instruments, industries, and other categories. It aims to maximize returns by investing in different areas that would each react differently to the same event.

How do you maximize return and minimize risk?

So, to increase return you must increase risk. To lessen risk, you must expect less return, but another way to lessen risk is to diversify—to spread out your investments among a number of different asset classes. Investing in different asset classes reduces your exposure to economic, asset class, and market risks.

How can you minimize the risk from your investments?

Strategy 2: Portfolio diversification

Portfolio diversification is the process of selecting a variety of investments within each asset class to help reduce investment risk. Diversification across asset classes may also help lessen the impact of major market swings on your portfolio.

Does portfolio diversification reduce return?

Within an asset class, diversification does not change the expected / mean return. If you own 1 or all 500 stocks in the S&P 500 you can expect your return to be the mean return of the S&P 500. ... Diversifying from that to add treasury bonds would reduce long term expected returns but also reduce volatility.

What are the dangers of over diversifying your portfolio?

Financial-industry experts also agree that over-diversification—buying more and more mutual funds, index funds, or exchange-traded funds—can amplify risk, stunt returns, and increase transaction costs and taxes.

What is the average annual return if someone invested 100% in bonds?

What is the average annual return if someone invested in 100% in bonds? -5.4% 2.

What is the best way to maximize return in a portfolio while minimizing risk?

Investments are usually made to earn high returns, but high returns come with high risks. Hence, to maximize your returns and minimize the risks, you need to diversify your portfolio. With a diversified investment strategy, you spread the risks of your investments across various asset classes.

How do you maximize portfolio returns?

Improve Your Investment Returns with These 7 Strategies

- Find Lower Cost Ways to Invest. ...

- Get Serious About Diversifying Your Portfolio. ...

- Rebalance Regularly. ...

- Take Advantage of Tax Efficient Investing. ...

- Tune-Out the “Experts” ...

- Continue Investing in Your Portfolio No Matter What the Market is Doing. ...

- Think Long-term.

What does maximize returns mean?

Generally speaking, the riskier an investment, the greater the potential returns — but also the greater the potential for losses. ...

Which kind of investment probably has a higher return?

Stocks / Equity Investments include stocks and stock mutual funds. These investments are considered the riskiest of the three major asset classes, but they also offer the greatest potential for high returns.

How can you minimize any risk you may have from investing in bonds?

Interest-Rate Changes

- The market value of the bonds you own will decline if interest rates rise. ...

- Don't buy bonds when interest rates are low or rising. ...

- Stick to short- and intermediate-term issues. ...

- Acquire bonds with different maturity dates to diversify your bond holdings.

Which is the safest way to invest money?

The Best Safe Investments For Your Money

- High-Yield Savings Accounts. High-yield savings accounts are just about the safest type of account for your money. ...

- Certificates of Deposit. ...

- Gold. ...

- U.S. Treasury Bonds. ...

- Series I Savings Bonds. ...

- Corporate Bonds. ...

- Real Estate. ...

- Preferred Stocks.

Yet No Comments