3 Problems with High Turnover Ratio Mutual Funds

- Is high turnover good or bad in a mutual fund?

- What are the 5 pitfalls of mutual funds?

- What is a high turnover rate for a mutual fund?

- Is a higher turnover ratio better?

- What is Portfolio turnover in mutual fund?

- What is considered a high turnover ratio?

- What is the downside of mutual funds?

- Can you get rich with mutual funds?

- Why mutual funds are bad?

- What is a good expense ratio for mutual funds?

- What mutual funds should I buy now?

- Do you want a high or low turnover rate?

Is high turnover good or bad in a mutual fund?

A mutual fund with a high turnover rate increases its costs to its investors. ... For example, a fund with a 25% turnover rate holds stocks for four years on average. The higher the turnover rate, the greater the turnover. Higher turnover rates mean increased fund expenses, which can reduce the fund's overall performance.

What are the 5 pitfalls of mutual funds?

5 Disadvantages of Mutual Funds

- Mutual Funds Have Hidden Fees.

- Mutual Funds Lack Liquidity.

- Mutual Funds Have High Sales Charges.

- Mutual Funds and Poor Trade Execution.

- All Mutual Funds Have High Capital Gains Distributions.

- Are There Disadvantages of Mutual Funds?

What is a high turnover rate for a mutual fund?

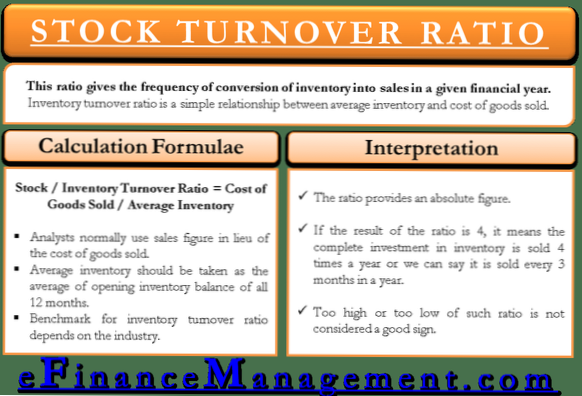

Generally, for all types of mutual funds, a low turnover ratio is less than 20% to 30%, and high turnover is above 50%.

Is a higher turnover ratio better?

The higher the asset turnover ratio, the better the company is performing, since higher ratios imply that the company is generating more revenue per dollar of assets. ... Comparisons are only meaningful when they are made for different companies within the same sector.

What is Portfolio turnover in mutual fund?

Portfolio turnover is a measure of how quickly securities in a fund are either bought or sold by the fund's managers, over a given period of time. The rate of turnover is important for potential investors to consider, as funds that have a high rate will also have higher fees to reflect the turnover costs.

What is considered a high turnover ratio?

Understanding Turnover Ratios

This figure is typically between 0% and 100%, but can be even higher for actively managed funds. ... A fund with a rate of 100% has an average holding period of less than a year. Some very aggressive funds have turnover rates much higher than 100%.

What is the downside of mutual funds?

Mutual funds are the most popular investment choice in the U.S. Advantages for investors include advanced portfolio management, dividend reinvestment, risk reduction, convenience, and fair pricing. Disadvantages include high fees, tax inefficiency, poor trade execution, and the potential for management abuses.

Can you get rich with mutual funds?

Investing in mutual funds is one of the most popular and effective ways to create wealth for the future. It is also a great way to generate passive income. This is due to the appealing long term returns and diverse investment options.

Why mutual funds are bad?

Mutual funds cling to the very things that all financial data says leads to underperformance: active management and high fees. Mutual funds are actively managed investments, which means the portfolio management team is making decisions about what to buy and sell all the time.

What is a good expense ratio for mutual funds?

A good expense ratio, from the investor's viewpoint, is around 0.5% to 0.75% for an actively managed portfolio. An expense ratio greater than 1.5% is considered high. The expense ratio for mutual funds is typically higher than expense ratios for ETFs. 2 This is because ETFs are passively managed.

What mutual funds should I buy now?

- Fidelity ZERO Large Cap Index (FNILX) The Fidelity ZERO Large Cap Index mutual fund is part of the investment company's foray into mutual funds with no expense ratio, thus its ZERO moniker. ...

- Vanguard S&P 500 ETF (VOO) ...

- SPDR S&P 500 ETF Trust (SPY) ...

- iShares Core S&P 500 ETF (IVV) ...

- Schwab S&P 500 Index Fund (SWPPX)

Do you want a high or low turnover rate?

Your company's turnover rate is the percentage of employees who voluntarily leave your company in one year. Of course, you want to shoot for a low turnover rate because this means, on average, fewer employees are leaving the company. Conversely, a high turnover rate means many of your employees, over a year, have quit.

Yet No Comments